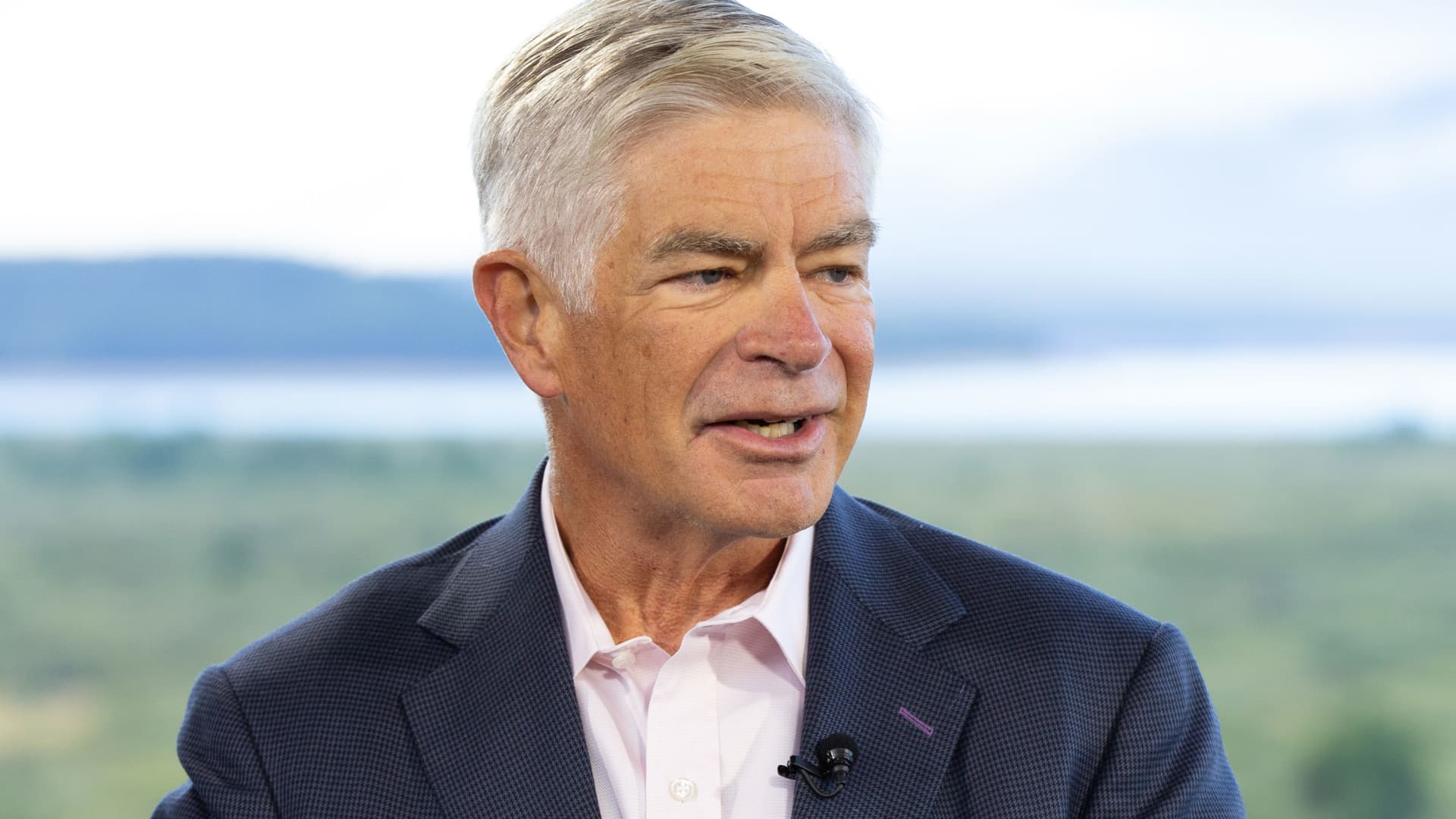

Patrick Harker at Jackson Hole, Wyoming

David A. Grogan | CNBC

Philadelphia Federal Reserve President Patrick Harker on Tuesday indicated that the central bank could be at the end of its current rate-hiking cycle.

A voter this year on the rate-setting Federal Open Market Committee, the central bank official noted progress in the fight against inflation and confidence in the economy.

“Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work,” Harker said in prepared remarks for a speech in Philadelphia.

That statement comes after the FOMC in July approved its 11th hike since March 2022, taking the Fed’s key interest rate from near zero to a target range of 5.25%-5.5%, the highest in more than 22 years.

While projections committee members made in June pointed to an additional quarter-point increase this year, there are differences of opinion on where to go from here. New York Fed President John Williams also indicated, in an interview with The New York Times published Monday, that the rate rises could be over. Fed Governor Michelle Bowman said Monday that she thinks additional hikes are probably warranted.

Markets are pricing in more than an 85% probability that the central bank holds steady at its Sept. 19-20 meeting, according to CME Group data. Pricing action indicates the first decrease could some as soon as March 2024.

Harker indicated there are unlikely to be rate cuts anytime soon.

“Allow me to be clear about one thing, however. Should we be at that point where we can hold steady, we will need to be there for a while,” he said. “The pandemic taught us to never say never, but I do not foresee any likely circumstance for an immediate easing of the policy rate.”

The Fed was forced into tightening mode after inflation hit its highest level in more than 40 years. Officials at first dismissed the price increases as “transitory,” then were forced into a round of tightening that included four consecutive three-quarter point increases.

While many economists fear the moves could drag the economy into recession, Harker expressed confidence that inflation will progress gradually to the Fed’s 2% goal, unemployment will rise only “slightly” and economic growth should be “slightly lower” than the pace so far in 2023. GDP increased at a 2% annualized pace in the first quarter and 2.4% in the second quarter.

“In sum, I expect only a modest slowdown in economic activity to go along with a slow but sure disinflation,” he said. “In other words, I do see us on the flight path to the soft landing we all hope for and that has proved quite elusive in the past.”

Harker did express some concern over commercial real estate as well as the impact that the resumption of student loan payments will have on the broader economy.

Policymakers will get their next look at the progress against inflation on Thursday, when the Bureau of Labor Statistics is scheduled to release its July reading on the consumer price index. The report is expected to show prices rising 0.2% from a month ago and 3.3% on a 12-month basis, according to economists polled by Dow Jones. Excluding food and energy costs, the CPI is projected to grow 0.2% and 4.8%, respectively.