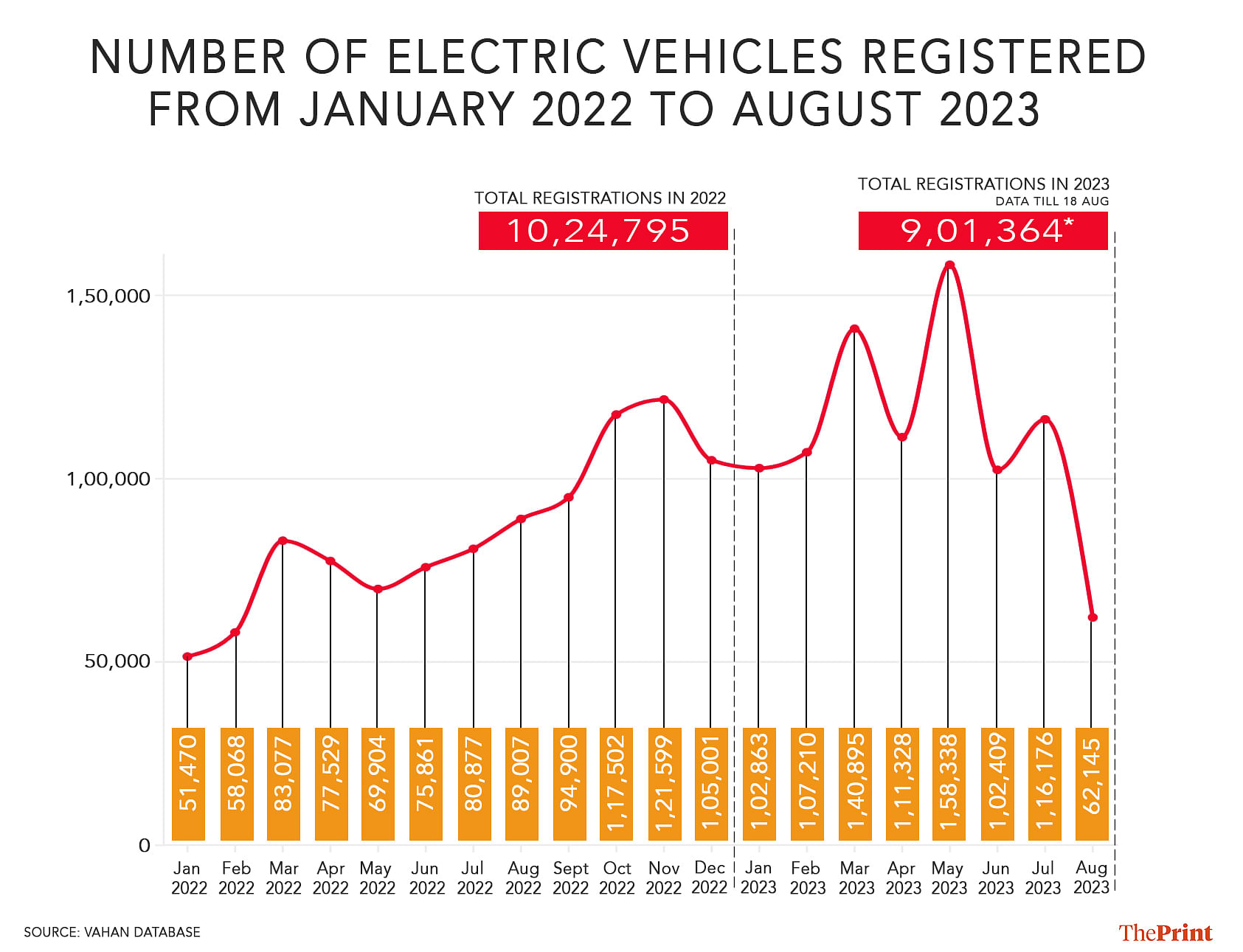

“In Q1 [first quarter] of FY ’24 (April-June 2023), the growth has been reasonably good as well,” he added.

Anand Kulkarni, chief product officer and head, high voltage programmes, Tata Passenger Electric Mobility, attributed the EV growth to the increasing awareness and acceptance of the technology among customers. He said that many of the initial questions and concerns about EVs have been answered over the past few years, and now users are choosing EVs as their primary vehicle.

“When we entered electrification, there was a certain view about how the technology would be useful and how it would be able to help, etc., and there were a lot of questions. Over the period of the last 3-3.5 years, I think many of those questions have been answered very emphatically. And what we have seen happen in this period is that the customers and their use cases have also evolved significantly,” he told ThePrint.

He cited the example of Tata Motors’ Nexon EV, which was launched in 2020 and was initially bought as a second or, in some cases, even the third car in the family.

“This was about people who wanted to look at the technology, but they were unsure of keeping this as their first car. Today, with the launch of the Tiago in January, we’ve seen a very significant shift happening… this was happening over a period of time, but was sort of accentuated by the Tiago,” he explained.

Highlighting numbers he said, 40 percent of their car buyers were using EVs as their primary car, which meant it was becoming mainstream.

“EVs are no longer being looked at as a supplementary car in the family,” he added.

And with infrastructure worries being addressed and removed, more choices available, and motor parts being locally manufactured, industry insiders expect sales to boom further.

Also Read: Hybrid car sales are catching up with that of electric vehicles in India — more affordable, resale value

Factors driving EV adoption

According to Kulkarni, among the factors that are driving EV growth are the great cost of ownership offered by EVs and excellent drivability and performance. He also said that most customers are able to charge their cars at home or on a low-power connection without any hassle.

“People earlier also had worries… What we see 1692595022 is that 95 percent of our owners are charging their cars at home or on a low-power connection,” he said.

There were also fears about whether you can have three or four cars in a particular apartment and whether suddenly there will be trip-offs [owing to charding] and things of that sort, he said. “But when you look at the fact that each car is probably adding load only worth one air conditioner, then you realise that these fears were indeed overrated,” he added.

Thakkar agreed that infrastructure challenges are not as big as they are perceived to be.

“If you look at two-wheelers, the movement is largely within the city and within a radius. About 80 percent of two-wheelers today are home charged, so in this case, charging infra is not a challenge,” he explained.

He added that for PVs, electric vehicles are being used as a second vehicle for city commutes. Moreover, the increasing awareness among youth about EVs and their environmental benefits is also boosting the demand, he said.

“They (youth) are also passionate about the environment, electric vehicles are also a style statement. Hence, EVs are doing really well in PVs also,” he said.

Thakkar further said that the availability of more options for customers has also helped in pushing EV sales.

“In the last couple of years, EV choices for customers have gone up. Earlier, there were very limited models available. In the next two-three years, we will see a lot of model launches in the PV space, giving customers more choices. With limited models, the customers were also waiting and watching how the vehicles perform etc. Now, people are more confident about EVs. Hence, we expect that ePVs (electric passenger vehicles) will cross the one lakh units sales mark this year,” he said.

Also Read: EVs are duping you about carbon emissions. Govt should let diesel cars run longer

EV sales expected to increase

Rahul Bhasin, associate director, growth advisory (mobility), at the business consulting firm Frost & Sullivan, noted that the rate of expansion in India’s electric vehicle charging infrastructure is impressive, with an annual substantial growth of 30-40 percent.

“This is especially significant considering that the country presently boasts around 8,000 to 9,000 public charging points, reflecting a proactive step towards fostering EV adoption and sustainability,” he said.

According to Crisil’s Thakkar, by 2030, more than 20 percent of new passenger vehicles sold annually or about 1.2-1.5 million units will be electric, and almost 30-35 percent of two-wheelers (2Ws) will be electric (or about 6 million electric).

He said that the only challenge that the industry has highlighted is the reduction in FAME II incentive amount for E2W (electric two-wheeler) to Rs 10,000/kWh from Rs 15,000/kWh with a cap of up to 20 percent (versus 40 percent earlier) of the ex-factory price, effective June 1 this year.

FAME II or faster adoption of manufacturing of electric vehicles scheme, was launched by the central government in 2019 to give a boost to the development of electric vehicles in the country.

“So there could be some near-term hiccups. But long term I don’t see a challenge. In fact, if things remain good we will close this year at about a million units sales of electric two-wheelers,” he added.

Echoing similar views, Manish Raj Singhania, president, Federation of Automobile Dealers Associations (FADA), told ThePrint that while reduction in FAME subsidy is a dampner for electric two-wheelers as it was helping push sales, such vehicles have “created a space in the minds of the customers”.

“Even without subsidies, electric two-wheelers are under their consideration. Plus earlier major players were largely start-ups. With bigger established players entering the market, options for customers will grow. Bigger players also help bring in larger distribution networks and trust,” he added.

“A lot of people are purchasing cars today, and just as a metric four years back when we started, the market for electric vehicles (cars) in the country was about 4,000-4,500 units a year. Today, it is almost hovering at 10,000 cars a month. So then definitely a significant amount of gain, and charging infrastructure is also getting set up, so worries about that are definitely abating,” Kulkarni explained.

Also Read: Clean fuels, road safety, EVs…but also snazzy cars: Auto Expo wraps up with ‘highest ever turnout’

Battery life & manufacturing ecosystem

Kulkarni also addressed the concerns over the battery life of an electric vehicle. He said a lot of people had concerns about whether the battery will last as long as the car, but with modern-day technology and chemistry, battery life has significantly improved.

For example, he explained, lithium-ion batteries can undergo up to 2,000 cycles of charge and discharge.

For 2,000 odd cycles and every cycle yielding — depending on what is the capacity of the battery — taking an hypothetical example of 200 kilometres, he added, “You are talking about 4,00,000kms. Going by current usage patterns, that is significantly in excess of 12-15 years.”

“So these concerns are on account of fear rather than reality. We also monitor cars in our fleet. For cars which have run a hundred thousand kilometres, the battery deterioration is probably less than five to six percent,” Kulkarni said.

Asked about the manufacturing ecosystem for EVs in the country, he added, when Tata Motors started EV manufacturing, a large number of components were imported — particularly the embedded electronics, the high voltage stuff and some of the motors.

“But as time has progressed, we, at Tata, wanted to bring in these technologies. We started by doing assembly first, then we started making components. Our batteries started becoming local, our motors are local… A large part of our component systems are also becoming local…So, all of that is already underway and it has happened to a large extent. To a certain extent, India is not currently a manufacturer of raw materials like lithium itself, and permanent magnets, which are an important part of what goes into the motor,” Kulkarni said.

He added that, while some imports will continue in the foreseeable future, in about three years, the company expects to get localised batteries even though initially some of the raw material could be sourced from outside India.

Thakkar further said that India was already seeing parts of EVs, such as motors and controllers, being localised to a certain extent.

“Battery currently is not localised because cells are imported. But most of the components in the future will be localised,” he said.

Localisation level is different for each vehicle segment, he explained, adding, “My estimate is that two-wheelers and PVs will have a little more than 50 percent localisation levels, it may be lower for buses. Overall, I would say it would be over 50 percent, and we should easily be able to achieve 70-75 percent localisation levels by FY30.”

(Edited by Richa Mishra)

Also Read: ‘Poor charging infrastructure, high prices’ — what’s putting the brakes on India’s 2030 EV target