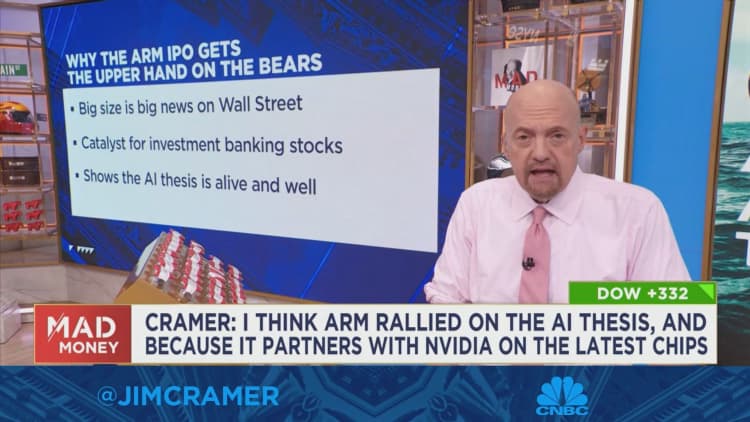

CNBC’s Jim Cramer on Thursday gave his take on Arm Holdings‘ initial public offering, saying the semiconductor designer’s market debut went as well as could be expected.

“I think this deal was pretty darn close, really, to a Goldilocks outcome and a good sign of things to come for the IPO market,” he said. “Arm went up enough to get people excited about new offerings again, but not so much that the whole thing became a travesty of a mockery of a sham.”

Valued at almost $60 billion at open, Arm is the largest company to go public since electric car manufacturer Rivian in 2021.

Arm itself is not a manufacturer. Instead, it creates semiconductor designs and licenses them to big industry names like Apple and Nvidia, collecting royalty fees for every semiconductor made using its technology. About half of the company’s royalty revenue comes from products released between 1990 and 2012, CNBC reported.

Cramer said he’s excited about the company’s potential because of its solid royalty-based business plan, emphasis on designing energy efficient products that produce less heat, as well as its monopoly on smartphone central processing units. However, he added that he’s wary of instances where private equity firms control a publicly traded company, as that can lead to public investors “getting the short end of the stick.” Post-IPO, Japanese investment company SoftBank controls about 90% of Arm.

Arm stock jumped nearly 25% during its first day of trading, starting Thursday priced at $51 but climbing to $63.59 by close. Despite this jump, Cramer suggested investors buy a small position in the stock.

“Listen, I wish that Arm’s stock had stayed in the low-to-mid fifties — it would be so easy for me to tell you to buy it — but even at $63, alright, I’m willing to justify putting on a small position here,” he said. “Either Arm continues to climb higher, in which case you’ve got a nice little winner, or it falls back down, at which point you can buy more on weakness at the price we’d prefer.”