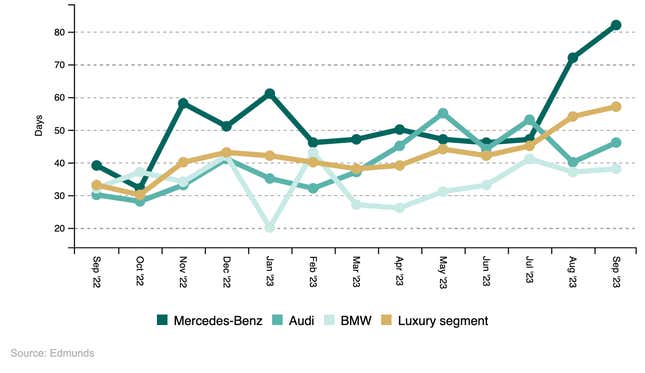

Mercedes-Benz electric vehicles are spending nearly three months sitting on dealer lots. Data shows that it took Mercedes dealers an average of 82 days to sell the automaker’s battery-powered EQ models, according to Automotive News.

That’s a lot even when you compare it to MB’s chief competitors: BMW and Audi. It takes those automakers an average of 38 and 46 days, respectively, and on average the luxury segment as a whole takes about 57 days to move electric vehicles.

Mercedes retailers who spoke with AutoNews blame their ever-expanding stockpiles of vehicles on the cars themselves and the brand’s unwillingness to enact sales programs as competition gets steeper. One store operator said he had a six-month supply of EVs on his lot, but only about a 50-day supply of gas-powered vehicles.

“The EVs are coming whether or not you asked for them or earned them,” he said. “There is too much of a price premium – especially a the top end of the EQ lineup – and almost no [lease] support.”

The executive said the EVs lack the “lust factor” of Mercedes’ gasoline-powered flagship models, such as the S-Class sedan and AMG-GT coupe.

“Our cars need to be ‘want’ cars,” he said. “The S-Class has maintained good loyalty because it’s aspirational. An EQS is not something that most people aspire to own.”

The automaker is reportedly responding to the discontent from dealers. Executives acknowledge that there’s an oversupply of EQS models at the expense of the more affordable EQB and EQE crossovers. Because of that, Mercedes is planning to slow down production on higher-end EQs while upping lower-tier EVs, plug-in hybrids and regular ICE vehicles, according to Automotive News. Retailers should – in theory – see a difference in inventory by the middle of 2024.

The automaker has reportedly attributed sluggish EV sales to product mix, supply chain issues and growing pains in a brand new-ish segment.

“We are with a new lineup in a new world,” Psillakis told Automotive News. “There is no past, there is no experience” with EVs, he said.

Supply chain hang-ups, meanwhile, have affected the electric product mix on dealership lots.

“We still face challenges around our product lines and have some restrictions coming from suppliers,” Psillakis said. “We don’t always get the volume we want when we want it.”

That’s kept some more affordable, faster-selling electric models, such as the compact EQB, from reaching dealership lots.

“We could not supply [the EQB] at the beginning of the year,” Psillakis said. “Now we can, but it takes some time” to reach retailers.

This news comes soon after the brand reported its U.S. EV sales surged more than fourfold in the first nine months of 2023. That’s mostly due to the introduction of the higher-volume EQE crossover and sedan, AutoNews says.

Jalopnik has reached out to Mercedes-Benz for comment, and we will update this article when and if we get a response.