One of the messages that Warren Buffett and Berkshire Hathaway’s top insurance executive, Ajit Jain, sent to investors during the company’s annual shareholder meeting in Omaha last month was that cyber insurance, while currently profitable, still has too many unknowns and risks for Berkshire, a huge player in the insurance market, to be fully comfortable underwriting.

Cyber insurance has become “a very fashionable product,” Jain said at the annual meeting. And it’s been a money maker for insurers, at least to date. He described current profitability as “fairly high” — at least 20% of the total premium ending up in the pockets of insurers. But at Berkshire, the message being sent to agents is one of caution. A primary reason is the difficulty in assessing how losses from a single occurrence don’t spiral into an aggregation of potential cyber losses. Jain gave the hypothetical example of when a major cloud provider’s platform “comes to a standstill.”

“That aggregation potential can be huge, and not being able to have a worst-case gap on it is what scares us,” he said.

“There’s no place where that kind of a dilemma enters into more than cyber,” Buffett said. “You may get an aggregation of risks that you never dreamt of, and maybe worse than some earthquake happening someplace.”

Berkshire is in the cyber insurance business

Industry analysts generally say while some of Berkshire’s caution is warranted, the general state of the cybersecurity insurance marketplace is stabilizing as it becomes profitable. And Gerald Glombicki, a senior director in Fitch Rating’s U.S. insurance group, points out that Berkshire Hathaway is issuing cybersecurity policies despite Buffett’s caution. According to Fitch’s analysis, Berkshire Hathaway is the sixth-largest issuer of such policies. Chubb, which Berkshire recently revealed a big investment in, and AIG are the largest.

“Right now [cybersecurity insurance] is still a viable business model for many insurers,” Glombicki said. It is still a tiny market, representing only one percent of all policies issued, according to Glombicki. Because the cybersecurity business is so small, it gives insurance companies latitude to implement various policies to see what is working, and what isn’t, without a tremendous amount of exposure.

Berkshire, as well as Chubb and AIG, declined to comment.

“There is an element of unpredictability that is very unsettling, and I understand where [Buffett] is coming from, but I think it is really hard to avoid cyber risk entirely,” Glombicki said. He added though that there has still been no significant litigation that assigns culpability or tests the boundaries of the policies, and until the courts hear some culpability cases, some insurers may proceed more cautiously.

‘Could break the company’ Buffett says

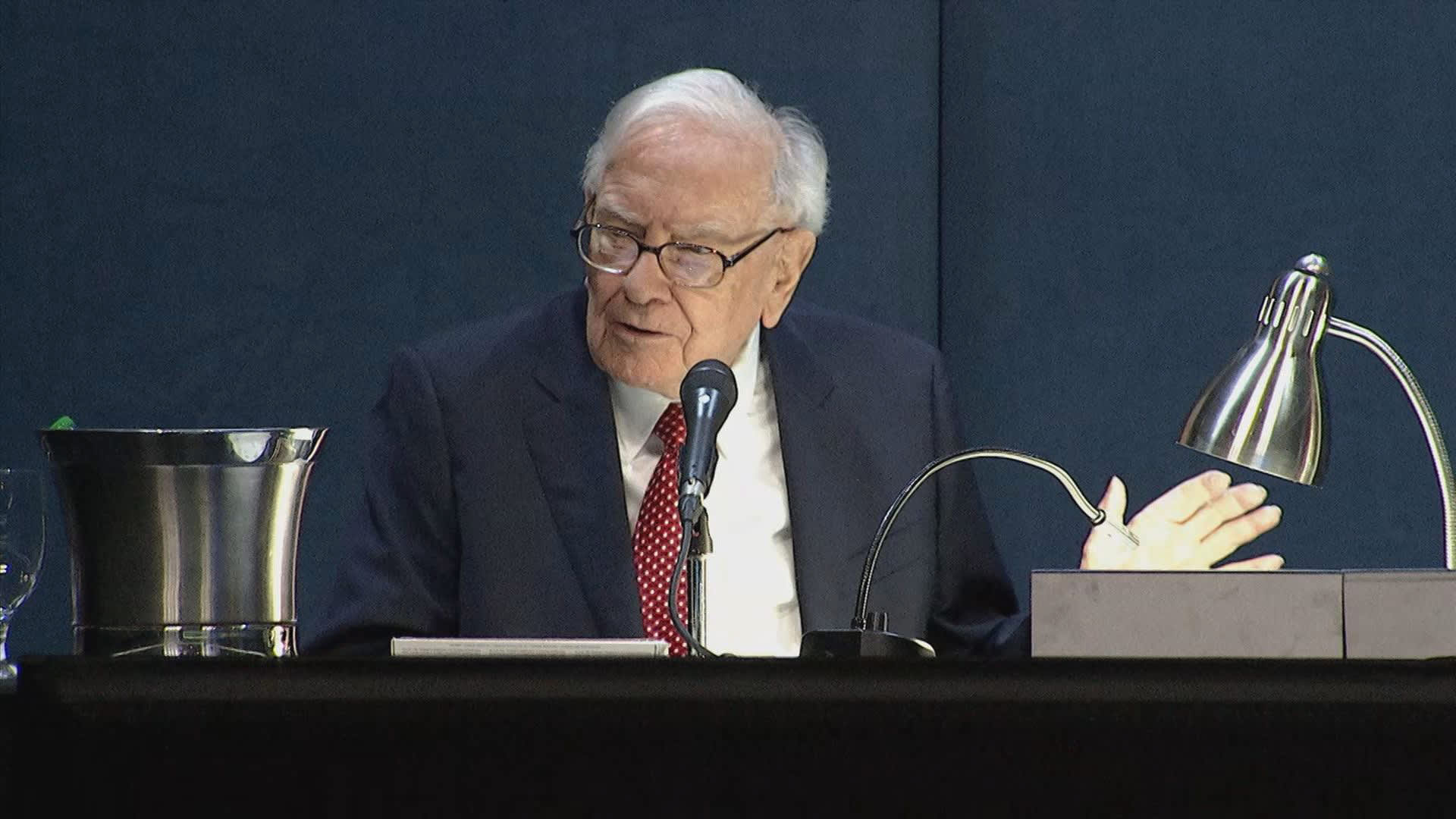

Top Berkshire executives Warren Buffett (L), Greg Abel (C) and Ajit Jain (R) during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 4, 2024.

CNBC

The problem with writing many policies, even with a $1 million limit per policy, is if a “single event” turns out to affect 1,000 policies. “You’ve written something that in no way we’re getting the proper price for, and could break the company,” Buffett said.

While some notable leaders, like former Homeland Security chief Michael Chertoff — who now runs a global security risk management firm — have called for a government cybersecurity backstop of some sort, most experts don’t believe that is needed right now. Glombicki says that while the feds are looking at what role they can play, intervention likely won’t happen until an incident prompts it.

Any government involvement “will probably happen after a big, expensive cyber-incident,” he said. “After September 11, the government put together a terrorist risk program. In cyber, we have not yet seen an attack of that scale. We are still in the stage of thinking about possible approaches.”

Cyber insurance data shows growth and market confidence

While the number of cybersecurity policies being written is small now, analysts don’t expect it to stay that way.

“Rates are declining, which shows stability in the market,” said Mark Friedlander, a spokesman for the Insurance Information Institute. According to its data, cyber premiums are estimated to double over the next decade. In 2022, premiums totaled $11.9 billion. By 2025, Friedlander says, they are expected to double to $22.5 billion and increase to $33.3 billion by 2027.

“This is clearly one of the fastest-growing segments of insurance. More companies are writing cybersecurity policies than ever before,” Friedlander said, attributing confidence among insurers to more sophisticated underwriting and stabilizing rates. He cited a 6% decline in cybersecurity insurance rates in the first quarter of 2024, following a 3% decline in 2024, as a clear signal that insurers feel more confident about jumping into the business.

“Most commercial insurance like auto, home, and life insurance have all been increasing, so the decline is significant. It is a sign of stability and a decline in claims severity,” Friedlander said.

And more insurers are entering the market because they have the tools and data to price the risk. “If you can do it at sound rates, you will write that coverage,” Friedlander said.

‘You’re losing money’

Buffett and his top insurance lieutenant don’t agree. It’s the insurance “loss cost” — what the cost of goods sold could potentially be — that has Berkshire on the fence with a bigger move into cyber insurance. Jain said losses have been “fairly well contained” to date — not exceeding 40 cents on the policy dollar over the past four to five years — but he added, “there’s not enough data to be able to hang your hat on and say what your true loss cost is.”

Jain said that in most cases agents are Berkshire are discouraged from writing cyber insurance, unless they need to write it to satisfy specific client needs. And even if they do, Jain leaves them with this message: “No matter how much you charge, you should tell yourself that each time you write a cyber insurance policy, you’re losing money. We can argue about how much money you’re losing, but the mindset should be you’re not making money on it. … And then we should go from there.”

Google Cloud says the risks are being overstated

There is a perception that cyber risk is rapidly changing and, therefore, too unpredictable to underwrite in a systematic way, says Monica Shokrai, head of business risk and insurance at Google Cloud. But she added that the perception doesn’t match reality, and that the risk can largely be managed.

“We don’t hold the same view as Warren Buffet on the topic,” she said. In Google’s view, the majority of cyber losses can be prevented or mitigated through basic cyber hygiene.

“By understanding security, you can get to a place where your controls are in a much better place, where the risk is more manageable,” Shokrai said. Devastating attacks from nation-states, meanwhile, are in a separate category and have been rare. Insurers are already inoculating themselves from potential risk by making exclusions for certain catastrophic events. Many cybersecurity policies have coverage exemptions for nation-state attacks.

“What they are trying to do is remain resilient and solvent in the event of a widespread event; what they have done to manage that is put in exclusions,” Shokrai said, and those include critical infrastructure, cyber war, and other widespread disruptive events.

Ambiguities and subjectivities remain. What if someone is the victim of a cyberattack from a foreign-based gang that isn’t officially tied to a nation-state but may have received some ancillary logistical support? Can an insurance company invoke a nation-state exclusion? Shokrai says categorizing how to attribute an event is the topic of much debate between insurance companies. “That is a big debate between insurance companies; it is an important distinction that needs clarity,” Shokrai said.

Some experts say it is the ambiguity surrounding the industry’s margins that has investors like Buffett and insurance players like Berkshire spooked. But so far, the business has proven to be sound overall. “It is still a viable business model for many insurers,” said Josephine Wolff, an associate professor of cybersecurity policy at The Fletcher School at Tufts University, who has been studying the evolving market for the past several years. But she added that a belief that the business is viable doesn’t mean things are not constantly changing, pointing to the recent ransomware surge over the past couple of years that saw large payouts by insurance companies — though notably still not enough to make the business unprofitable for most issuers.

Cyber insurance helps make the entire ecosystem safer, according to Steve Griffin, co-founder of L3 Networks, a California-based managed services provider that specializes in cybersecurity. Policies require companies to adhere to certain cyber standards to attain coverage, and the more businesses that sign up for coverage, the safer the entire system becomes. And if a business knows they’ll be denied a claim if they don’t have some basic cybersecurity safeguards in place, that acts as an incentive to put them in place.

Berkshire does believe the business will grow, it just isn’t sure at what cost. “My guess is at some point it might become a huge business, but it might be associated with huge losses,” Jain said.

“I will tell you that most people want to be in anything that’s fashionable when they write insurance. And cyber’s an easy issue,” Buffett said. “You can write a lot of it. The agents like it. They’re getting the commission on every policy they write. … I would say that human nature is such that most insurance companies will get very excited and their agents will get very excited, and it’s very fashionable and it’s kind of interesting, and as Charlie [Munger] would say, it may be rat poison.”

While Griffin understands Buffett’s caution, he sees a generational divide over the risk outlook, and is optimistic about the cybersecurity insurance sector.

“Probably Warren Buffet would have called cybersecurity insurance an opportunity when he was younger,” he said.