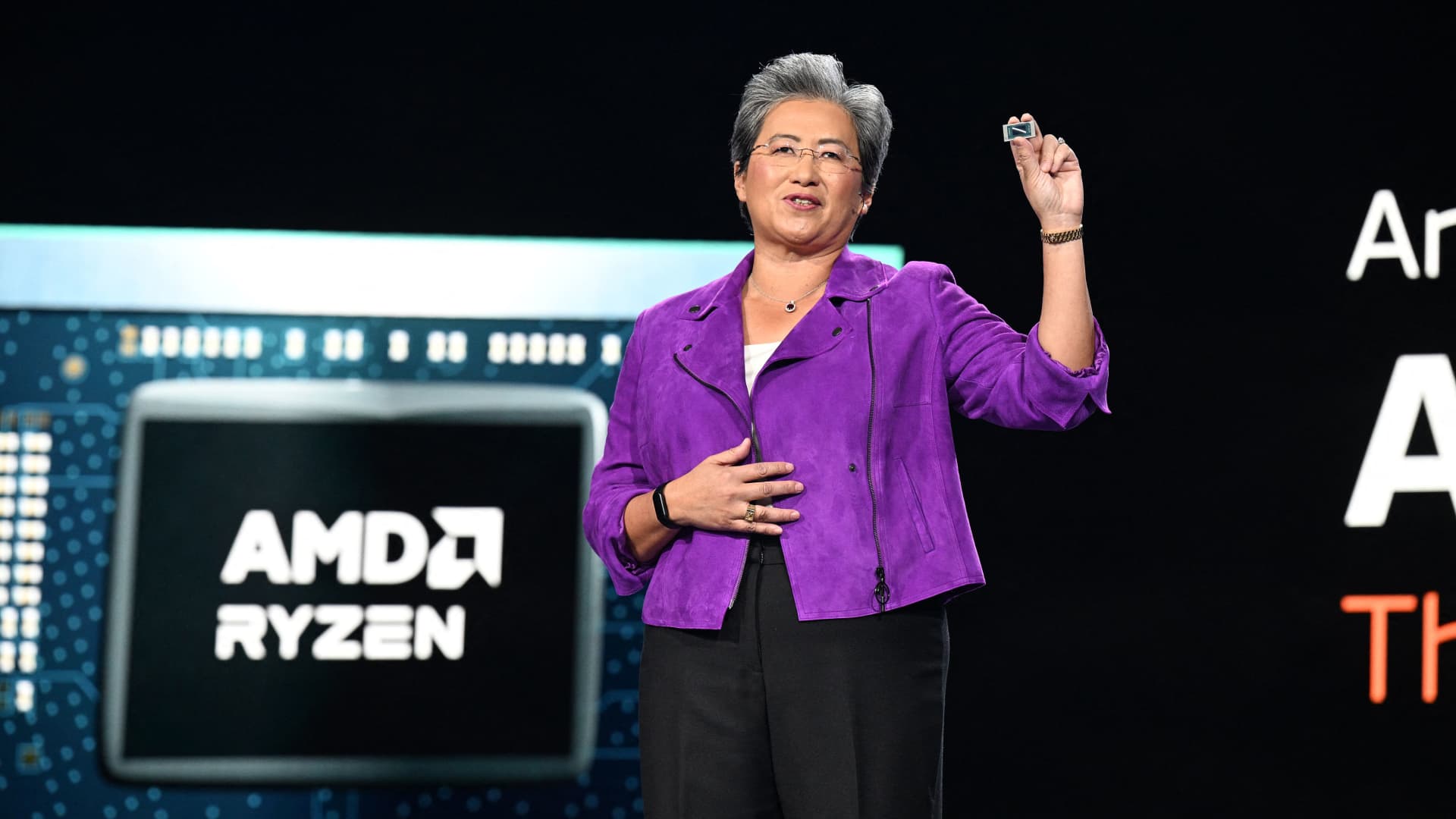

AMD Chair and CEO Lisa Su speaks at the AMD Keynote address during the Consumer Electronics Show (CES) on January 4, 2023 in Las Vegas, Nevada.

Robyn Beck | AFP | Getty Images

AMD reported third-quarter earnings on Tuesday that beat analyst expectations, though the chipmaker issued a weaker-than-expected forecast. The stock initially dropped about 4% in extended trading but recovered after the company gave a forecast for its AI chip business.

Here’s how the company did versus LSEG (formerly Refinitiv) consensus estimates for the quarter ending September:

- EPS: 70 cents adjusted, versus expectations of 68 cents per share

- Revenue: $5.8 billion, versus expectations of $5.7 billion

For the fourth quarter, AMD said it expects about $6.1 billion in sales, while analysts were looking for revenue of $6.37 billion.

Net income in the third quarter rose to $299 million, or 18 cents per share, from $66 million, or 4 cents per share a year ago. Revenue increased 4% from $5.6 billion a year earlier.

Data center, which includes AMD’s server processors and AI chips called GPUs, reported $1.6 billion in sales, flat from a year earlier. AMD said its sales of server CPUs grew. AMD also said that it expects strong growth in its data center business in the fourth quarter.

“We now expect data center GPU revenue to be approximately $400 million in the fourth quarter and exceed $2 billion in 2024 as revenue ramps throughout the year,” Su said.

AMD is one of the few chipmakers capable of making the kind of high-end graphics processing units (GPUs) needed to train and deploy generative AI models. That market is dominated by Nvidia. AMD said its forthcoming AI chips, the MI300A and MI300X, are “on track” for volume production in the current quarter.

On a call with analysts, Su also also mentioned recent AI acquisitions and improvements in the company’s AI software suite.

“Within the AI space, we’ve had very good customer engagement across the board from hyperscalers to OEMs, enterprise customers, and some of the new AI start-ups that are out there,” Su said.

Revenue in AMD’s Client group, which includes sales from PC processors, rose 42% on an annual basis to $1.5 billion, driven by PC chips.

Last week, chief rival Intel reported third-quarter earnings that beat expectations for profit and sales, but still showed an annual sales decline.

AMD’s embedded segment revenue declined 5% to $1.2 billion, which the company blamed on a weak communications market. That includes parts for networking as well as the company’s FPGA unit that it acquired when it bought Xilinx.

Sales in AMD’s gaming segment declined 8% to $1.5 billion, because of fewer “semi-custom” chip sales. That’s what the company calls its business that makes processors for consoles like Sony’s PlayStation 5.