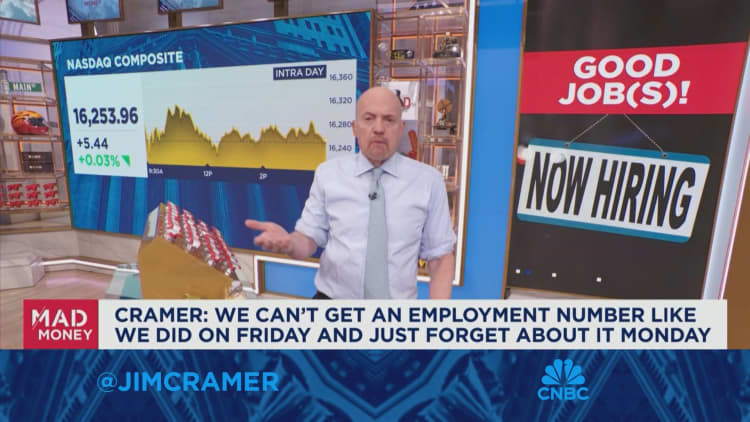

CNBC’s Jim Cramer reviewed last week’s nonfarm payroll report and highlighted the thriving economy, telling investors not to expect imminent rate cuts from the Federal Reserve.

“If you’re hoping for Fed rate cuts … I say maybe don’t hold your breath. This economy doesn’t need them,” he said. “Just be glad we aren’t getting any more rate hikes.”

To Cramer, this monthly report contains the most consequential government data, adding that he’s analyzed it for more than a decade and it’s never lost its significance.

Nonfarm payrolls — the number of jobs in the government and the private sector — rose by 303,000 in March, topping the Dow Jones estimate of 200,000. The unemployment rate was 3.8%, as expected. Cramer called the country an “economic miracle,” asking investors to picture what the landscape might look like if the Fed were trying to create jobs rather than keeping rates high to restrain growth.

Cramer also commented on what this report means for the consumer, which is always something top of mind on Wall Street, as employment affects consumer spending, he asserted. The report showed job growth in the leisure and hospitality industry, returning to pre-pandemic levels in February 2020. To Cramer, this means investors can worry less about a cash-strapped consumer, saying the data further indicates a roaring economy.

“We have a robust economy, so I’m a lot less worried about this upcoming earnings season,” Cramer said. “When I check the record, historically, this kind of job creation without a ton of inflation is about as good as it gets, regardless of where short-term interest rates are sitting.”