CNBC’s Jim Cramer on Friday told investors what to look for next week on Wall Street, including earnings from retailers like Target.

According to Cramer, March’s market has come in like a bull — not a lion — but he wondered if it will go out like one too. He said the economy’s not so hot that bullish investors are fighting the Federal Reserve, and earnings season has been fairly positive, so they’re not “fighting the tape,” or going against prevailing market trends, either.

“You don’t want to get complacent here, and after this run it’s real easy to fall into complacency, isn’t it? But, then again, complacency — or, let’s just call it, how about, a willingness to let it ride — has been paying pretty well. … Forget not fighting the tape, right now, we’re absolutely loving it,” he said.

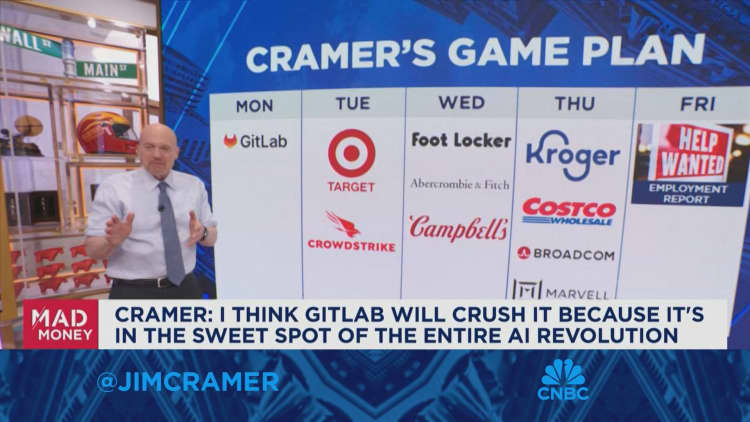

On Monday, Cramer said he’ll be waiting for earnings results from GitLab. Since tech and enterprise software have led much of this market’s rally, he said he thinks the software company will perform well as it’s “in the sweet spot of the entire artificial intelligence revolution.”

Tuesday brings earnings from Target and Cramer said he’s optimistic about the big-box retailer’s performance. CrowdStrike is set to report after close, and Cramer noted it’s not been an easy moment for cybersecurity, with peer Palo Alto Networks‘ stock declining after a disappointing quarter. Nonetheless, Cramer expressed faith in CrowdStrike CEO George Kurtz and encouraged investors to “hang in there” because the industry is “the hottest it’s been in years”

Retailers Abercrombie & Fitch and Foot Locker report on Wednesday. Cramer called the former a “serial beat and raise outfit” and said he thinks it’s on a roll. And although the latter’s turnaround hasn’t been easy, the shoe seller has managed to pull its stock out of a hole. Campbell Soup also reports Wednesday, and with its large snack portfolio, Cramer said he wonders if the company can bring in strong earnings in an environment where more consumers are using weight-loss drugs and may not be as interested in junk food.

On Thursday, Cramer will be paying attention to earnings from grocers Kroger and Costco, as well as Marvell Technology. The Federal Trade Commission challenged Kroger’s recent attempt to merge with Albertsons, and Cramer said he’s wary of the stock because the grocer will likely have to play “litigation roulette.” Cramer said he thinks Costco will turn out strong figures, and Marvell’s artificial intelligence business will do well even if other sectors of the company are softer.

Friday brings February’s unemployment report. If there’s a slight boost in unemployment while wages stay steady, Cramer said he thinks investors won’t have to fight the Fed.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Palo Alto Networks, Costco and Foot Locker.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com