New Delhi: Buoyed by the rising exports of medical devices, the government has identified about 110 equipment which it plans to promote through local manufacturing in a big way over the next five years, ThePrint has learnt.

Medical devices comprise nearly 15,000 most commonly used equipment from syringes to the most sophisticated positron emission tomography (PET) scans, according to industry experts.

As per a roadmap prepared by the Department of Pharmaceuticals (DoP) under the Ministry of Chemicals and Fertilisers, the plan is to leverage the country’s existing strength by supporting and promoting 113 identified products that are being manufactured in India.

These medical devices include specific equipment across eight segments — cancer therapy, imaging, assistive medical devices, body implants, surgical instruments and hospital equipment, consumables and disposables, in-vitro diagnostic instruments, and reagents.

The devices and equipment which are in focus are cochlear, breast, knee and hip implants, hearing aids and contact lenses, X-ray machines and ultrasounds, chemotherapy devices, ventilators, defibrillators and dialysis machines among others.

Other devices in the category include syringes and stethoscopes, surgical gowns and drapes, masks and kits to test pregnancy, mosquito borne diseases, TB, HIV and other sexually transmitted diseases, pulse oximeters and heart lung machines.

These products are slated to be manufactured by both Indian companies and multinationals with manufacturing units in the country.

As per the government data accessed by ThePrint, India imported devices worth $8,188 million in 2023-24, but also exported equipment worth $3,785 million.

The segment where most of the medical equipment was exported included consumables and disposables such as masks, syringes, gloves, catheters among others and imaging equipment such as X-ray and ultrasound machines.

“A large share of medical devices that are used in India continue to be imported but over the last three years, we have managed to raise the import coverage ratio (measure of a country’s ability to pay for its imports with its exports) from 0.34 in 2021-22 to 0.46 in 2023-24,” DoP secretary Arunish Chawla told ThePrint.

The government figures show that the compound annual growth rate (CAGR) of export of medical devices over the last 4 years is 13.9 percent while the CAGR of import has been 8.6 percent.

The target, according to the DOP secretary, is to reduce India’s import dependence from the present level of about 75 percent to 50 percent in five years.

“We aim to improve export competitiveness for medical devices through value added manufacturing through building capacity to manufacture world class and high-quality products and raise import coverage ratio to 1 over the next five years,” Chawla added.

Also Read: ICMR back in race to offer world’s 1st vaccine for deadly shigella, to tie up with Indian manufacturer

Need for ‘focused attention’

As per the government figures, the market size of the medical devices sector in India was estimated to be $14 billion (nearly Rs 1,10,000 crore) in 2022 and its share in the global medical device market was estimated to be 1.5 percent.

Under the Centre’s production linked incentive (PLI) scheme — first introduced in 2020 — for medical devices, the government has announced support for setting up 4 medical devices parks in Himachal Pradesh, Madhya Pradesh, Tamil Nadu, and Uttar Pradesh.

As part of the scheme, till now, a total of 26 projects have been approved, with a committed investment of Rs 1,206 crore. Out of this, an investment of Rs 958 crore has been achieved.

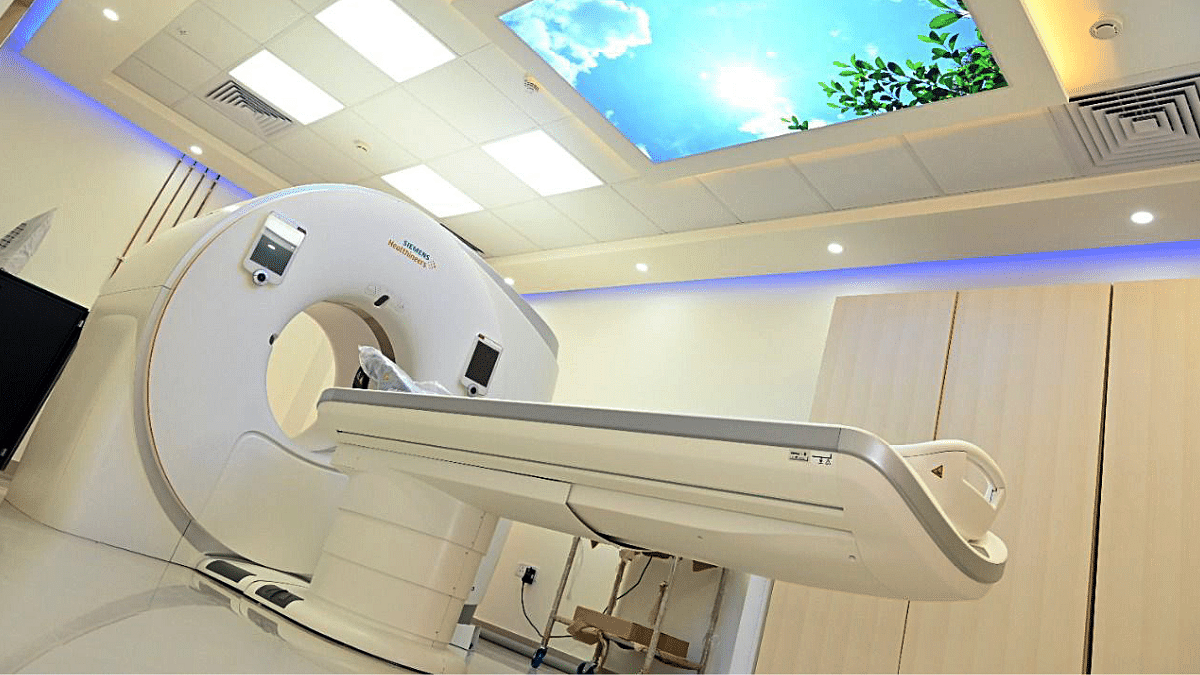

Also, a total of 14 projects producing 37 products have been commissioned and domestic manufacturing of high-end medical devices has started which include linear accelerator, magnetic resonance imaging (MRI) scan, computed tomography (CT) scan, mammogram, and high-end X-ray tubes.

Last year, the Union Cabinet approved the National Medical Devices Policy aimed at facilitating an orderly growth of the sector through measures such as regulatory streamlining, enabling infrastructure, facilitating R&D, and attracting investment.

But industry veterans such as Association of Indian Medical Device Industry (AiMeD) forum coordinator Rajiv Nath told ThePrint that so far, India has seen maximum success in exports of disposable and consumables. “So, initial focus should be here to build on global competitiveness.”

The DoP figures support Nath’s statement. In 2021-22, India exported consumables and disposables worth $1,387 million which rose to $1,752 million in 2023-24. During the same period, the share of import in the segment came down from $1,624-$1,185 million.

Pavan Choudary, chairman of the Medical Technology Association of India (MTaI), also underlined that while the government is incentivising manufacturing for medtech through various schemes and policies, the new and productive turn is of proximate advantage as it is focusing on areas where the country already has some underlying strengths like medical textiles, consumables, software, and AI.

“Most med tech hubs around the world specialise in a few segments that they robustly manufacture and export, and these segments lie in the vicinity of their existing strengths. We, therefore, believe that this directional change in the government’s emphasis and its thorough execution as is being witnessed will galvanise the med tech — Make in India programme,” he said.

(Edited by Tony Rai)

Also Read: India gets 1st guidelines for managing lipid levels, the biggest risk factor for heart attack, stroke