Automakers said alternative fuel technologies such as electric, hybrids, compressed natural gas (CNG), biogas and flex fuel need to coexist with traditional fuel options of petrol and diesel to support the transition to cleaner and more sustainable transport options.

This fragmentation has led to different auto companies dominating different emerging segments even as most automakers have a sizeable portfolio of petrol and diesel models.

Maruti Suzuki, for example, leads in CNG and hybrids but has no presence yet in electric while homegrown Tata Motors leads in electric vehicles (EVs) and has a strong presence in CNG but lacks hybrids, data collated by Jato Dynamics show.

Mahindra & Mahindra has electric and mild hybrid models but no CNG while Korean carmakers Hyundai and Kia have a presence in CNG and electric but no presence in hybrids.

“The Indian car market’s powertrain landscape is not a one-size-fits-all scenario; it’s a complex interplay between established technologies like petrol and diesel, the strategic adoption of alternatives like CNG and hybrids, and the ongoing development of electric vehicles,” said Ravi Bhatia, president of Jato Dynamics.

“As the market evolves, carmakers that can adapt and offer a diverse range of powertrain options are likely to be the ones that thrive in this multi-gear future,” he said.

There is a growing demand for cleaner, greener powertrains both from urban and upcountry areas, industry insiders said. Customers are increasingly choosing alternate fuel options with the intent of economical as well as more eco-friendly drive. Customers are starting to prefer electric and hybrid vehicles because of their lower running costs, they said.

Additionally, regulatory nudges — the central government, for example, has set a target of 30% EV contribution to sales across vehicle segments by 2030 — are pushing manufacturers to launch more models in these segments.

Maruti Suzuki will be producing its first EV in 2024-25 with the introduction of eVX in the mid SUV category, its senior executive director Shashank Srivastava said. It plans to have six EV models by 2030-31, he said.

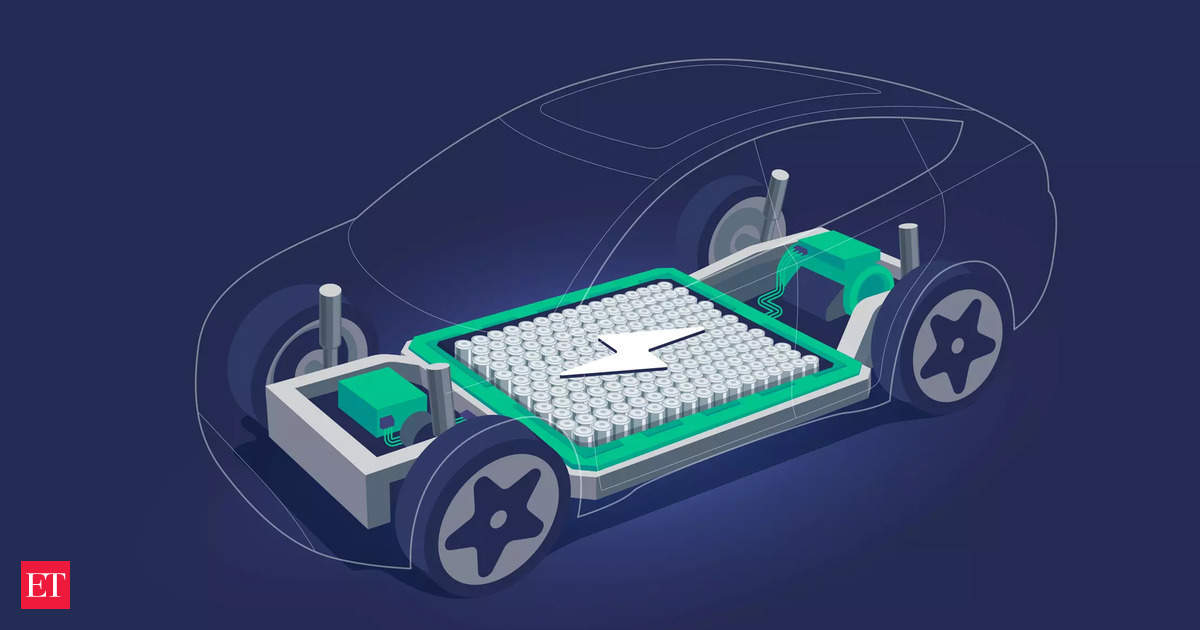

Growing charging network is helping boost customer confidence in EVs. However, supply chain, battery costs and charging infrastructure have to significantly improve before fully electric cars can take off in a big way, industry insiders said.

HYBRIDS BRIDGE TRANSITION

Hybrids are seen as a bridge for the transition from traditional fuels to electric. Toyota and Maruti Suzuki are pitching strong hybrids to retail as well as fleet customers, who may not be ready to make the shift to fully battery-powered vehicles.

According to Srivastava, Maruti’s powertrain break-up in 2030 will be 15% electric, 25% hybrid, and the balance a mix of gasoline, CNG and flex fuel, or flexible-fuel vehicles that can run on more than one type of fuel. Currently, CNG vehicles account for about 26% of total sales of the country’s largest carmaker. As many as 14 out of its 17 models have CNG options, Srivastava said.

The Indian market now boasts of a diverse range of CNG models, with more than 20 variants available across different body types and price points, offered by various OEMs.

The proliferation of CNG refuelling stations across the nation has also been a game changer, industry insiders said.