The major force behind this year’s AI trade has cooled off in recent weeks. Nvidia shares have essentially traded sideways since CEO Jensen Huang addressed developers at the company’s GTC conference nearly three weeks ago. Huang announced a new chip platform, Blackwell, and spent plenty of time talking about new software and services. It advanced Nvidia’s efforts to create an ecosystem of software and services around its must-have artificial intelligence hardware — taking a page out of Apple ‘s playbook. Earlier in the week , we focused on Microsoft , Alphabet , Amazon and Meta Platforms ‘ (and to some extent Apple’s) AI efforts and their stock moves. But we’d be remiss if we didn’t look at the lay of the land at Nvidia, which has thus far been the biggest financial winner of the AI wave that’s swept Wall Street since late 2022. That’s when ChatGPT’s viral launch opened investors’ eyes to what is possible with generative artificial intelligence, which refers to machines making content in response to user prompts. AI may seem like an overnight success story, but Nvidia and Alphabet’s Google have been working on artificial intelligence for decades. “For three decades we’ve pursued accelerated computing, with the goal of enabling transformative breakthroughs like deep learning and AI,” Huang said at GTC. At Alphabet, Google put together a timeline back to 2001 to highlight its AI breakthroughs. A major milestone came 2017 when Google introduced the transformer architecture , on which ChatGPT was built. It is fair to say that without Nvidia the current generative AI wave would not be possible yet. It’s been Nvidia’s semiconductors that make AI work. As demand for accelerated computing power takes off, and the company works to further build out its services, we think there’s more upside to be had in the stock. It’s why Jim Cramer put Nvidia in the rarified air of Apple as the only two stocks in the Club portfolio deemed “own them, don’t trade them.” It’s no wonder shares have surged nearly 75% year to date after more than tripling in 2023. But the stock, as it’s known to do, has hit a bit of a rough patch — completing a three-day slide as of Thursday’s close. It’s been down in five down sessions in the past seven. NVDA 5Y mountain Nvidia 5 years This year has been a transition from imagining what generative AI could be – a dynamic that’s leading the major players to buy as much computing power as they can from the likes of Nvidia – to how the buzzy technology can be monetized. The clearest examples at the moment are Microsoft’s Copilot AI assistants and Meta’s enhanced advertising tools . The AI hierarchy right now looks something like this: Semiconductors are scooped up by the hyperscale cloud providers — Amazon Web Services, Microsoft’s Azure and Google Cloud — who then deliver compute to their enterprise customers. We’re currently at the beginning of hyperscaler monetization. It’s a theme we’ll be hearing a lot about on earnings calls in the coming months and years. As these companies ramp up their efforts to sell AI products to their own customers, the next stage will be margin expansion, in which customers can then take those products and leverage them to increase their own profitability. This is a high-level theme investors should be monitoring in the years to come. It won’t happen overnight, but it all plays off of AI adoption. The trick is figuring out what part of the adoption curve we are at. Last year, we ran a hypothetical model on how Starbucks could benefit from AI chatbots at its drive-thru windows. We noted then that if four of the 21 employees at company-operated U.S. locations, on average, could be reallocated, the result would be almost 5 percentage points of operating margin expansion or a 27% increase in operating profit. At the time, we knew Wendy’s and Jack in the Box were early believers in generative AI at drive-thrus. More recently, McDonald’s told Jim the fast-food giant is using chatbots at drive-thrus. That’s just one industry. Put another way, look for the benefits of AI adoption to trickle through the economy and profit margins to expand as it does. The companies best able to adopt this new technology are the ones most likely to see the most upside in the years ahead. Adoption starts with Nvidia, which can’t churn out chips fast enough as this dynamic emerges. However, Huang and Co. are not standing still as they look to growth markets such as governments around the world. Nvidia’s CEO has said that every country must have its own AI infrastructure. To be sure, the U.S. government has put trade rules around chip exports to China , rooted in national security concerns, that have resulted in lower sales for Nvidia in the world’s second-largest economy. Even if Nvidia’s latest made-for-China chips to comply with regulations are not as well-received in that market, there are still so many other would-be-buyer nations, as well as companies, that can benefit from Nvidia’s offerings. Putting it all together, the beautiful thing for investors is we don’t need to look for a new investment theme every single time; we just need to monitor the same AI theme and track where the biggest gains are set to be over the next year or so. So, as the benefits of AI trickle through the “AI supply chain,” look for the benefits of AI to spread and earnings to grow as a result. (Jim Cramer’s Charitable Trust is long NVDA, AAPL, GOOGL, AMZN, MSFT, META, which make up our Super Six tech mega-caps . See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

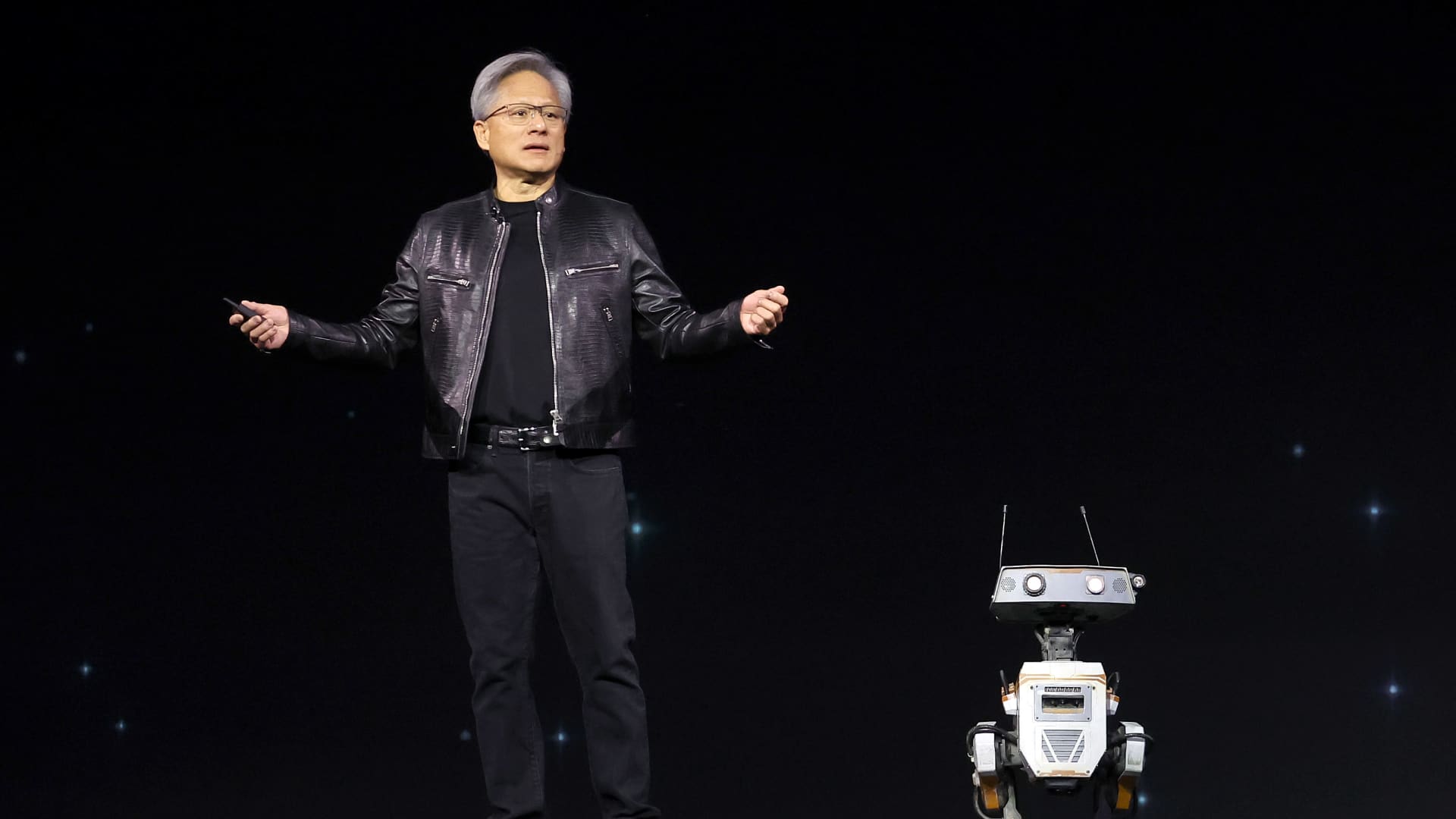

Nvidia CEO Jensen Huang delivers a keynote address during the Nvidia GTC Artificial Intelligence Conference at SAP Center on March 18, 2024 in San Jose, California.

Justin Sullivan | Getty Images

The major force behind this year’s AI trade has cooled off in recent weeks.

Denial of responsibility! Swift Telecast is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – swifttelecast.com. The content will be deleted within 24 hours.