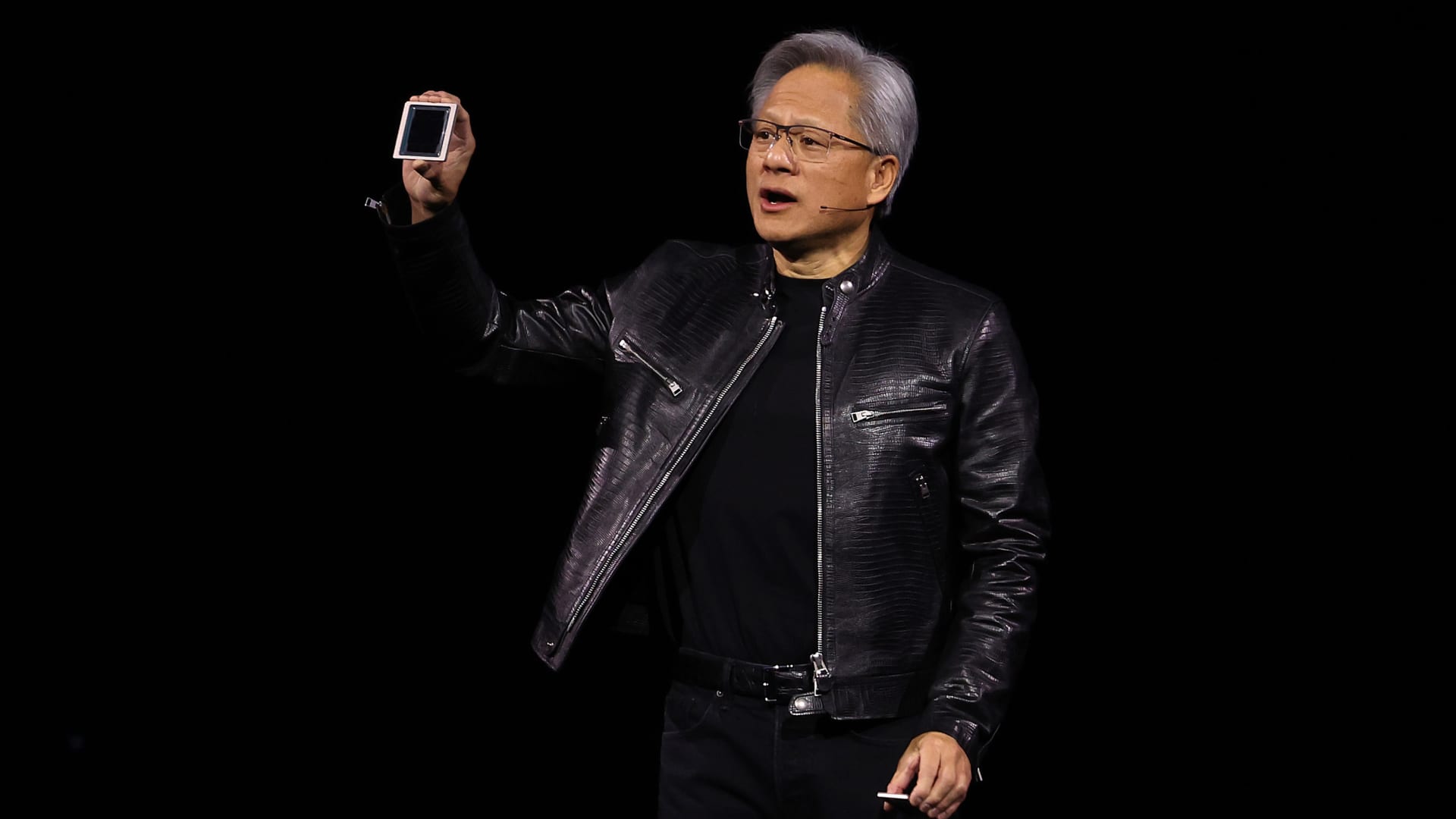

Nvidia CEO Jensen Huang delivers a keynote address during the Nvidia GTC Conference at the SAP Center in San Jose, California, on March 18, 2024.

Justin Sullivan | Getty Images

Last week, Nvidia announced deals with Johnson & Johnson for use of generative AI in surgery, and with GE Healthcare to improve medical imaging. The health care developments at its 2024 GTC AI conference, — which also included the launch of roughly two dozen new AI-powered, healthcare-focused tools — demonstrate just how important medicine is to Nvidia’s non-tech sector revenue opportunities in the future.

“The reason why Nvidia is so popular today is because it basically provided the plumbing and the technology for something that you could not do simply before or if you had to do something like this you would need probably several times more time, money and cost,” said Raj Joshi, a technology analyst and senior vice president at Moody’s Ratings. “Health care, whether it’s biotechnology, chemicals, or drug discovery is a very powerful area.”

Nvidia shares are up close to 100% year-to-date, and the biotech industry is an example of the untapped potential that investors are continue to bet on. AI can speed up the process of drug discovery and even find uses for drugs that may have failed to produce results for the initial disease they were developed to target.

“Over the last 18 months or so, we tend to believe it is more hope than hype because of the tangible outcomes and then the very compelling use cases how AI helped with the pharmaceutical industry, medtech industry or biotech industry,” said Arda Ural, EY Americas health and life sciences industry market leader.

Drug development is a risky process that can take at least a decade from concept to clinical studies, Ural said. It’s also a process that can cost billions, with a high chance of failure.

About 41 percent of biotech CEOs surveyed by EY in late 2023 said they were looking at “concrete” ways generative AI could be used for their companies. “This is very high for my experience, having been 30 years in this industry,” Ural said. “This is a really unique feature we are seeing with AI that’s being picked up much faster than other technologies.”

The health care focus from Nvidia at its conference was a doubling down on an ambition it’s had for a long time. During an earnings call with investors in February, Nvidia mentioned several ways its technology was being adapted for the medical field. Companies like Recursion Pharmaceuticals and Generate: Biomedicines have been expanding their biomedical research with the help of hyperscale or GPU specialized cloud providers, and they need Nvidia AI infrastructure to facilitate the process.

“In healthcare, digital biology and generative AI are helping to reinvent drug discovery, surgery, medical imaging and wearable devices,” said Colette Kress, Nvidia chief financial officer. “We have built deep domain expertise in healthcare over the past decade, creating the NVIDIA Clara healthcare platform and NVIDIA BioNeMo, a generative AI service to develop, customize and deploy AI foundation models for computer-aided drug discovery.”

Last year, NVIDIA invested $50 million in Recursion for its drug discovery projects. Recursion is inputting its biological and chemical data to train NVIDIA’s AI models on its cloud platform. The company has also worked with Roche’s Genentech to develop new medications and better treatment protocols. It also partnered in 2021 with Schrödinger for drug discovery.

One of NVIDIA’s greatest health-care strengths to date is the BioNeMo platform, a generative AI cloud service specifically made for drug development.

“It’s one thing to design semiconductors and computing platforms for others to do something. But it’s another thing altogether when you can build full-fledged packages of technology that you can sell to a customer,” Joshi said. “Let’s say if you are a biotech firm, you take the full technology from Nvidia, and you just start working on it as opposed to figuring out ‘how do I use this information technology?'”

Biotech-focused generative AI platforms have the ability to reduce costs for pharmaceutical companies beyond the drug development process. Many firms offshored their back office processes for supply chain, finance and administrative functions, as well as manufacturing, to save money. But with the rise in geopolitical tensions and the emphasis on bringing jobs back to the U.S., moving jobs overseas has become an increasing cost.

“Now you can do that at home with AI with a much lower cost because you have now robotic process automation, powered by AI,” Ural said. “So it’s not only helping speed up the drug development, but also it helps with lowering the cost of running a company. That means you can deploy more of the capital towards drug development and find more cures faster.”

The health-care space is an example of how far a company that was designing gaming graphics cards a decade ago has come. “You have to give credit to them that Jensen had the foresight way back in 2012 when he saw some people actually use his graphics card at Stanford University to solve some types of mathematical problem,” Joshi said. “He said, ‘You know what, this can actually be used to do what is called general computing, you know, the things that we all do everyday on a normal basis.'”

But to fully realize the benefits of AI that are just becoming clear in the health-care sector, leaders will need to get more support from one of the nation’s largest workforces. According to EY’s AI Anxiety in Business survey, more than two-thirds of health science and wellness employees have concerns about the use of AI, and 7 out of 10 are anxious about AI adoption in the workplace.