The latest euro zone inflation figures are “comforting” — but oil prices still pose a risk that could push the European Central Bank into another rate hike, Belgium’s central bank governor said Thursday.

“It is one of the factors that, you know, could push inflation higher … inflation would be higher in a way that we will not meet our target in [2025], then I think would have to do more,” Pierre Wunsch told CNBC’s Joumanna Bercetche, referring to a persistent shock in the price of oil.

“If inflation would be higher than our forecast, no more than marginally, then I think we have to do more,” he also said.

When asked whether this marked a change in approach for the ECB, many members of which in 2021 described inflation driven by energy markets as transitory, Wunsch said: “I think it’s just our reading of the impact of a succession of shocks has changed.”

The last 23 years of observing and modeling inflation had led policymakers to believe “sustained inflation was becoming close to impossible,” Wunsch said in an interview at the International Monetary Fund’s annual meetings in Marrakech, Morocco.

“So we were willing to look through a lot of shocks just because we hadn’t seen inflation above 2% for a long period of time. We’ve seen that now … It’s just the way we understand that inflation can be more persistent than we thought.”

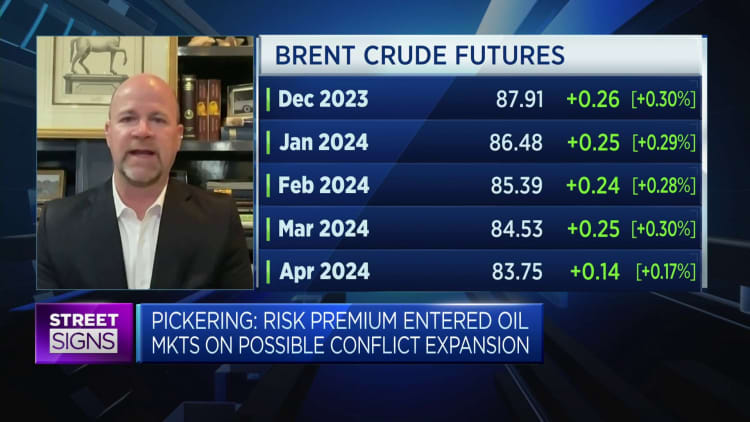

Oil prices rose sharply in September, crossing the $90 a barrel threshold for the first time since November 2022, before retreating slightly. However, the potential for huge instability now hangs over the market amid the devastating Israel-Hamas war.

The International Energy Agency on Thursday said the conflict was “fraught with uncertainty” and that it “stands ready to act if necessary to ensure markets remain adequately supplied.”

But like other ECB Governing Council members at the IMF conference, Wunsch told CNBC that inflation was “going in the right direction” and that if it developed in line with current forecasts, another hike should not be needed.

The ECB in September hiked its key rates to record highs, but also said they “have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

It now sees inflation averaging at 5.6% this year, 3.2% next year and 2.1% in the “medium term.”

Bank of Portugal Governor Mario Centeno told CNBC on Wednesday: “Bar additional shocks that we don’t see coming, of course, we will be done, that’s my interpretation of the decision in September.”

Meanwhile, governor of the Austria’s central bank, Robert Holzmann, said the ECB could implement one or two further interest rate increases, if there are “additional shocks” to the economy.