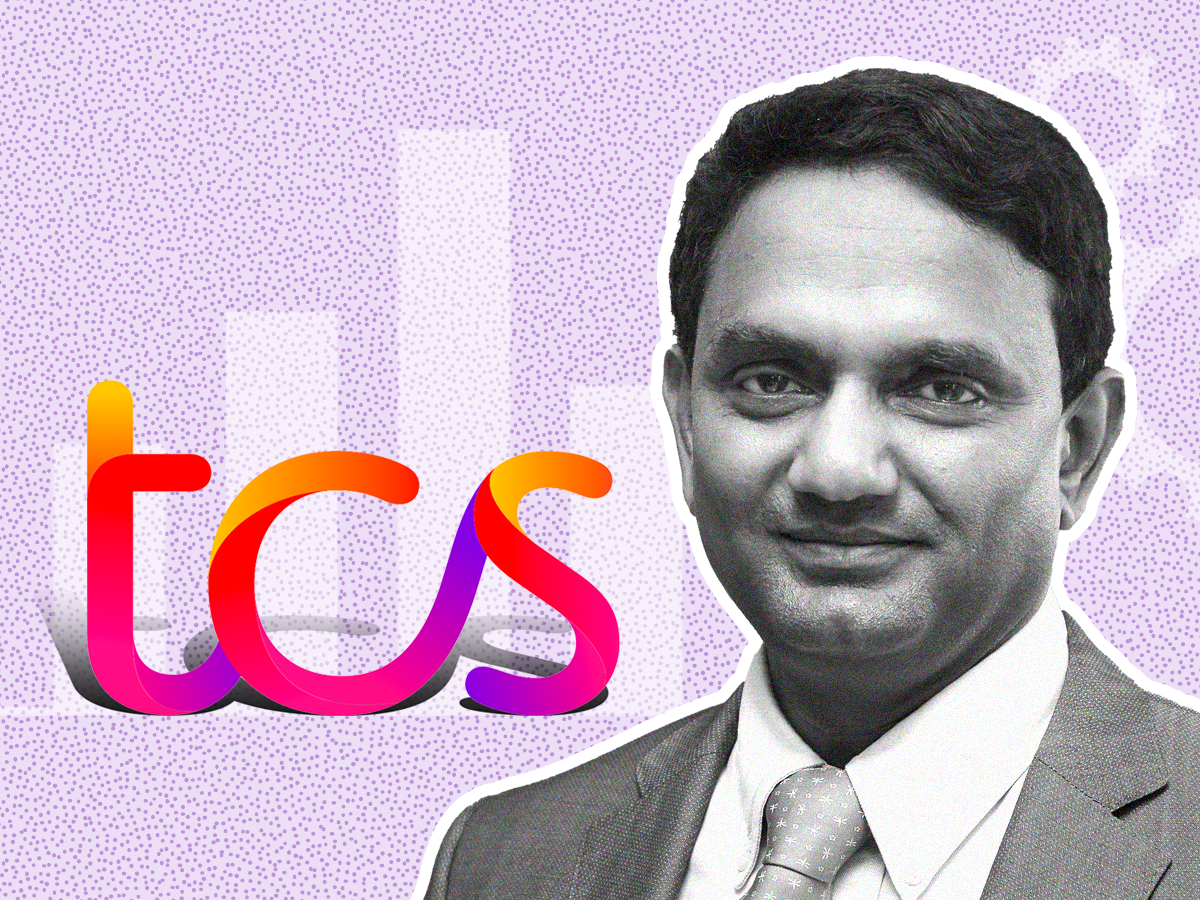

India’s top software exporter, Tata Consultancy Services (TCS), is looking to diversify its focus to new markets in the face of a slowdown in North America. TCS CEO K Krithivasan announced plans to increase investment in Japan, Latin America, and Southern Europe, citing their significant growth potential.

This strategic move comes after TCS reported its slowest quarterly profit growth since the year 2020.Revenue from its core North American market has also declined for four consecutive quarters. While Krithivasan emphasizes that TCS isn’t intentionally reducing its North American presence, the company clearly recognizes the need for diversification.

North America’s challenges

North America has traditionally been a crucial market for the Indian IT companies, with many companies heavily reliant on the region. However, recent economic uncertainties and inflationary pressures have caused IT clients there to tighten their spending, particularly on non-essential projects.

Untapped potential elsewhere

TCS sees promising opportunities in other markets with less exposure to North America’s challenges. Japan, for example, is one of the world’s largest tech spenders but currently contributes very little to the Indian IT sector’s revenue. Krithivasan believes there’s significant room for growth in such markets despite potential language and cultural barriers.

Focus on home market

In addition to exploring new frontiers, TCS is also paying closer attention to its domestic market. India contributed 6.1% of the company’s revenue in the latest quarter, the highest level in several years. This renewed focus on the home market further underscores TCS’s commitment to diversifying its revenue streams.

Despite the challenges of the current year, Krithivasan remains optimistic about the future. He believes that fiscal 2025 could be a significantly better year for TCS and the Indian IT industry as a whole. This optimism contrasts with the cautious outlooks of other industry players, who have recently downgraded their annual revenue forecasts.

IT stocks rally lifts markets to new lifetime high

Benchmark equity indices Sensex and Nifty surged over 1 per cent to hit their fresh all-time highs on Friday, driven by a stellar rally in IT stocks after TCS and Infosys reported better-than-expected financial results. Tata Consultancy Services climbed nearly 4 per cent after the largest software exporter reported an 8.2 per cent growth in net income for the December quarter at Rs 11,735 crore, driven by a massive growth in the home market that offset to a large extent the impact of a 3 per cent degrowth in the US market.

This strategic move comes after TCS reported its slowest quarterly profit growth since the year 2020.Revenue from its core North American market has also declined for four consecutive quarters. While Krithivasan emphasizes that TCS isn’t intentionally reducing its North American presence, the company clearly recognizes the need for diversification.

North America’s challenges

North America has traditionally been a crucial market for the Indian IT companies, with many companies heavily reliant on the region. However, recent economic uncertainties and inflationary pressures have caused IT clients there to tighten their spending, particularly on non-essential projects.

Untapped potential elsewhere

TCS sees promising opportunities in other markets with less exposure to North America’s challenges. Japan, for example, is one of the world’s largest tech spenders but currently contributes very little to the Indian IT sector’s revenue. Krithivasan believes there’s significant room for growth in such markets despite potential language and cultural barriers.

Focus on home market

In addition to exploring new frontiers, TCS is also paying closer attention to its domestic market. India contributed 6.1% of the company’s revenue in the latest quarter, the highest level in several years. This renewed focus on the home market further underscores TCS’s commitment to diversifying its revenue streams.

Despite the challenges of the current year, Krithivasan remains optimistic about the future. He believes that fiscal 2025 could be a significantly better year for TCS and the Indian IT industry as a whole. This optimism contrasts with the cautious outlooks of other industry players, who have recently downgraded their annual revenue forecasts.

IT stocks rally lifts markets to new lifetime high

Benchmark equity indices Sensex and Nifty surged over 1 per cent to hit their fresh all-time highs on Friday, driven by a stellar rally in IT stocks after TCS and Infosys reported better-than-expected financial results. Tata Consultancy Services climbed nearly 4 per cent after the largest software exporter reported an 8.2 per cent growth in net income for the December quarter at Rs 11,735 crore, driven by a massive growth in the home market that offset to a large extent the impact of a 3 per cent degrowth in the US market.

Denial of responsibility! Swift Telecast is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – swifttelecast.com. The content will be deleted within 24 hours.