Technology stocks had a remarkable performance in the first half of 2023, driving Wall Street and the Club’s portfolio to new heights. The Nasdaq Composite, dominated by tech companies, achieved its best first half since 1983, with a 32.7% increase by the end of June. The S&P 500 also saw strong gains, rising 8.3% in Q2 and 15.9% year to date. However, the Dow Jones Industrial Average, which has less exposure to tech, lagged behind with a 3.8% increase. Within our portfolio, our tech holdings, led by Nvidia, saw significant success, while other sectors such as retail and healthcare faced challenges, mainly due to disappointing earnings. Let’s take a closer look at the best and worst performers in the Club’s portfolio in the first half of 2023.

The Winners

-

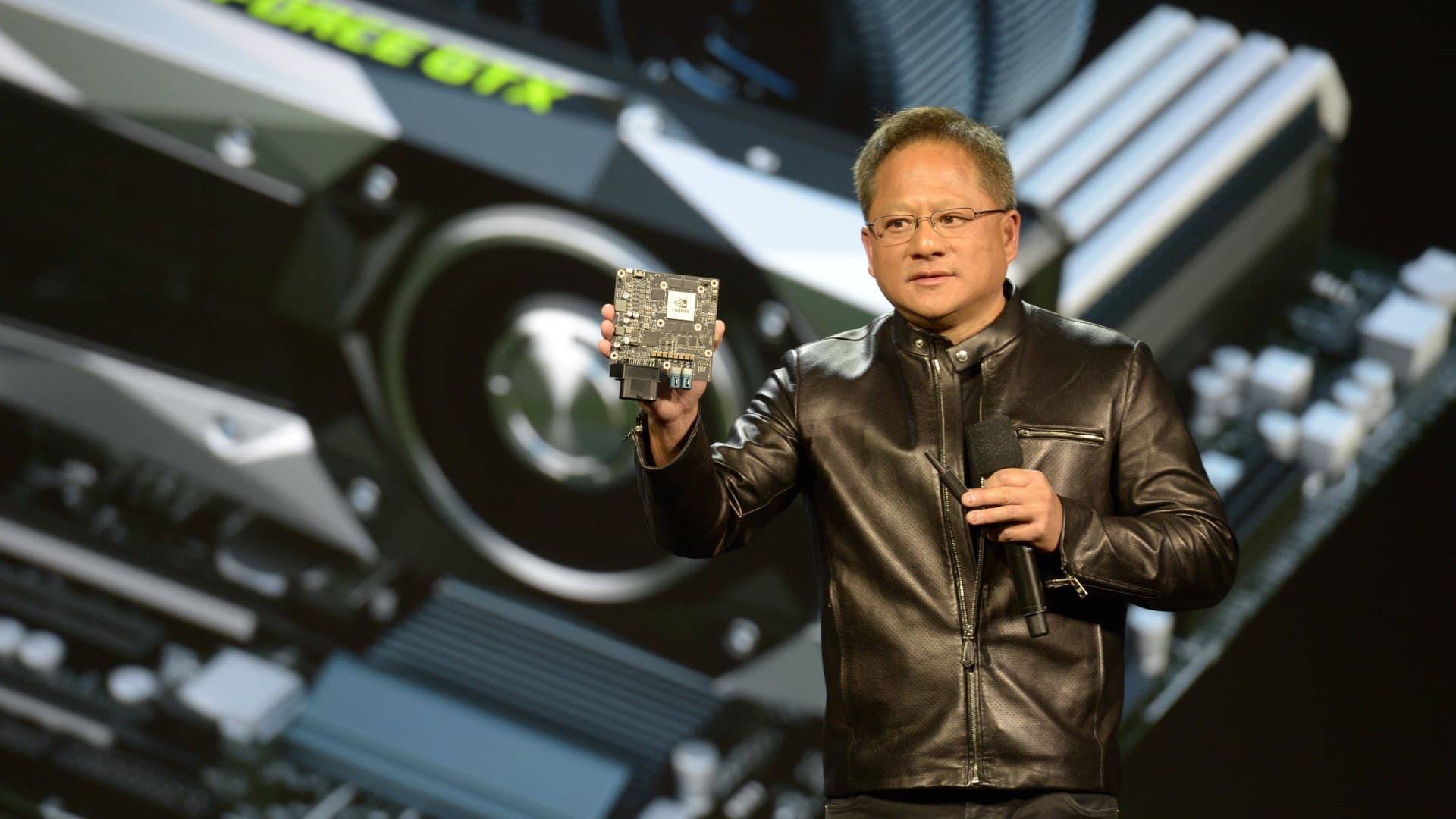

Nvidia (NVDA)

Nvidia dominated the first half of 2023, with its stock nearly tripling in value, soaring by 189.5%. As a semiconductor firm valued at over $1 trillion, Nvidia was the top-performing S&P 500 stock. The market recognized Nvidia’s pivotal role in enabling artificial intelligence, driving investor optimism. With cutting-edge graphics processors, like ChatGPT, and software capabilities such as CUDA and pretrained models, Nvidia has a strong competitive advantage in the AI field. The company’s AI chip demand reached new heights in Q2, leading to impressive guidance and positive market sentiment. Analysts have revised their estimates, projecting a 75% increase in earnings per share for fiscal year 2024 compared to previous expectations. Additionally, Nvidia’s rebounding gaming business further boosted its stock.

-

Meta Platforms (META)

Meta Platforms, the parent company of Facebook and Instagram, was the second-best performer in the first half, gaining 138.5%. The execution of Meta’s “year of efficiency” strategy, which focused on improved monetization and content recommendations using AI, resonated with investors. As the digital advertising market started to recover and with the growing popularity of its Reels feature, Meta demonstrated solid financial results. The company is expected to be a strong player in the AI race due to its AI-driven approach to attract more advertisers and increase user engagement.

-

Palo Alto Networks (PANW)

Palo Alto Networks, a cybersecurity company, achieved an 83.1% increase in the first half of 2023. Its profitability and inclusion in the S&P 500 in Q2 fueled its success. The company’s platform approach, offering physical firewalls and cloud-native products, appealed to value-conscious customers seeking consolidation in their security spending. Palo Alto is well-positioned to benefit from the ongoing trend of consolidation in the cybersecurity industry.

-

Advanced Micro Devices (AMD)

Advanced Micro Devices had a strong start to the year, with its stock rising by 75.9% in the first half. AMD’s success was mainly driven by the increasing demand for AI-related technologies across the tech industry. While not at the same level as Nvidia, AMD’s chips are expected to play a part in the AI ecosystem in the future. However, we decided to take some profits in late May as we believed the stock gains were getting ahead of its actual AI-related revenue contribution.

The Laggards

-

Foot Locker (FL)

Foot Locker experienced the biggest decline among Club stocks, with its shares falling by 28.3% in the first half. Disappointing first-quarter results were the primary reason for this decline. The company’s “Lace Up” strategy, which aimed to turn around its business, failed to meet expectations. To regain investor confidence, Foot Locker needs to demonstrate momentum in its business turnaround.

-

Estee Lauder (EL)

Estee Lauder’s stock dropped by 20.9% in the first half, making it the second-worst performer in the Club’s portfolio. China’s economic recovery fell short of expectations, leading to inventory issues at Estee Lauder’s duty-free stores. As products didn’t sell as anticipated, the company faced challenges. The market reacted to these issues, resulting in a significant decrease in Estee Lauder’s stock value.

The shift in market sentiment throughout 2022, favoring value stocks, changed in the first half of 2023 as high-multiple tech stocks, especially those tied to artificial intelligence, regained favor. Notably, Nvidia, Meta, and Palo Alto Networks were not only the top performers in the first half but also excelled in the second quarter. In contrast, Eli Lilly replaced AMD as one of the top Q2 performers, benefiting from positive drug trial data and progress in its obesity-and-diabetes therapies.