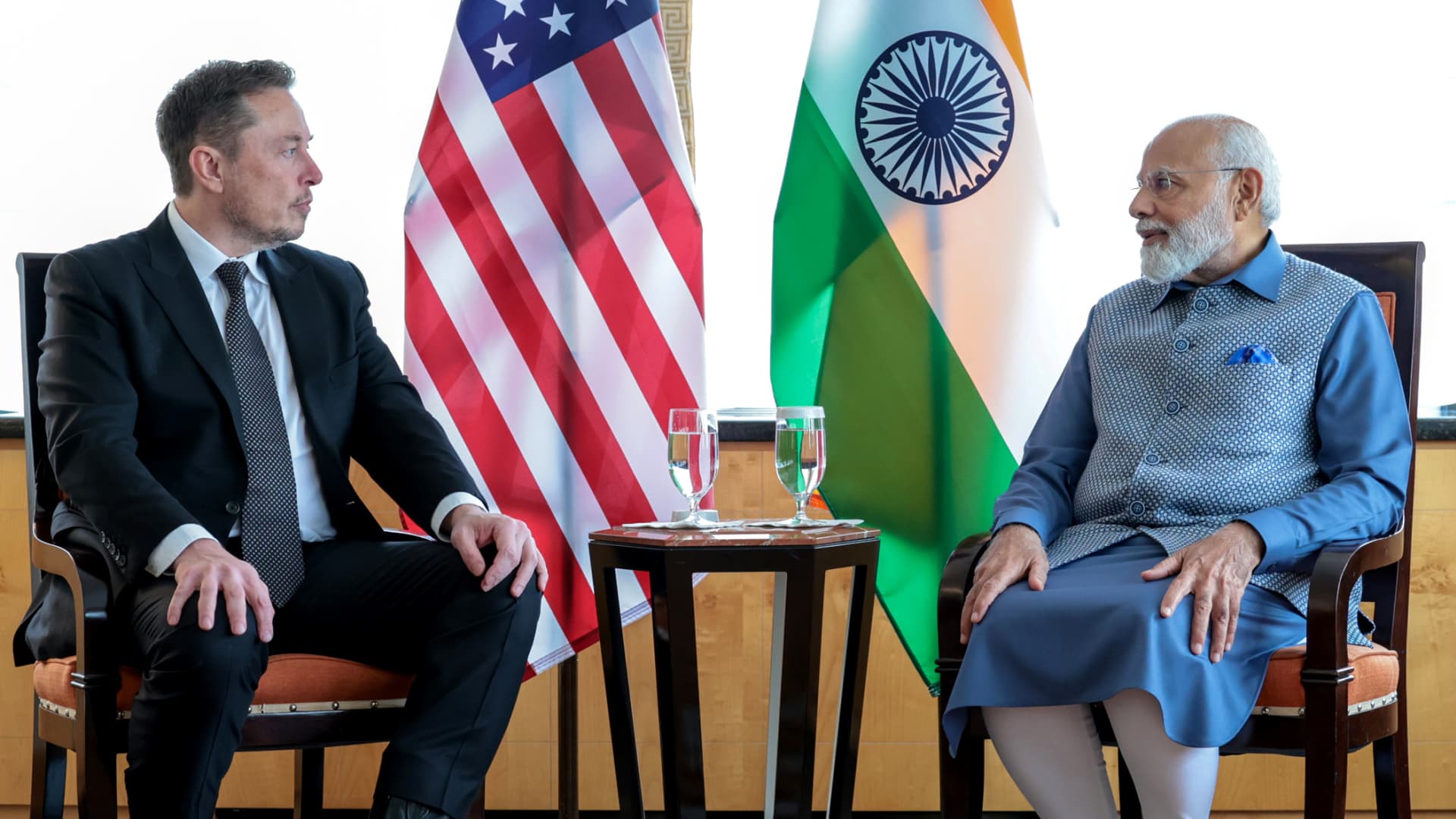

Indian Prime Minister Narendra Modi (R) meets with Elon Musk (L) in New York, United States on June 20, 2023.

Indian Press Information Bureau | Anadolu Agency | Getty Images

This report is from this week’s CNBC’s “Inside India” which brings you timely, insightful news and market commentary on the emerging powerhouse and the big businesses behind its meteoric rise. Like what you see? You can subscribe here.

The big story

Tesla chief Elon Musk is set to meet Indian Prime Minister Narendra Modi soon, and the timing couldn’t be any better.

For whom, you ask? Both!

India is gearing up for a general election that will be conducted over a month and a half.

The governing party, BJP, is widely expected to win and has pledged to attract foreign investment and boost economic growth.

Manufacturing features prominently in its manifesto released earlier this week. So it’s no surprise that the incumbent wants to show off Musk’s presence in India. After all, the Tesla boss employs around 140,000 people globally and manufactures one of the most advanced cars in the world.

For Musk, a battered stock and a global slowdown in auto sales are obvious motivators for his visit to booming India. Investors would welcome any news that the world’s largest EV maker was going to enter the third-largest auto market.

To make things easier, India lowered the barrier to entry for foreign automakers earlier this year, just as China did in the previous decade. Import tariffs on foreign cars have been cut from 100% to 15% for vehicles above $35,000 — a move that’s been mooted as a direct effort to attract Tesla.

The lowered tariffs are also conditional on automakers investing $500 million in three years to manufacture vehicles locally. Until then, they won’t be permitted to sell more than 8,000 cars annually and benefit from the cheaper import tax rate.

It makes India look like an obvious bet for Tesla — if one ignores certain risks.

Will Tesla continue to benefit from government policy if the electoral results throw up a surprise, for instance? And is it even worth investing a reported $2 billion to set up a factory in India?

EV sales made up 2% of the 4.1 million cars sold in the country in 2023, according to Bank of America. Meanwhile, a similar number of vehicles are sold in China every two or three months despite the economic slowdown there, with EVs making up nearly a third of those volumes.

Telsa will also find competing on cost challenging. Around 70% of India’s auto market is dominated by Tata Motors, which sells cars for between $10,000 and $20,000. Even Tesla’s rumored cheaper Model 2, which is expected to be manufactured in India, will cost more than this.

Even if India makes sense as a manufacturing base to export cheaper vehicles, demand for EVs is slowing in a big way. Tesla has cut around 14,000 jobs globally to reduce costs as margins get squeezed by poor sales figures.

In any case, Tesla’s potential arrival in India would certainly give job creation a boost — something Modi is keen to push. In that case, the real winners could be India’s young and growing population keen for jobs and better cars.

What happened in the markets?

The Indian stock market indexes Sensex and Nifty 50 are having a brutal week and have lost about 2.4% so far thanks to geopolitics, bad inflation and strong consumer spending data. The benchmarks are up by 0.34% and 1.22% so far this year, respectively.

The 10-year Indian government bond yield has risen alongside global bond markets this week to 7.18%. The greenback has gained against the Indian currency and now changes for 83.54 rupees a dollar.

For equity investors, the iShares MSCI India ETF has lost 2.3% so far this week, underperforming the iShares All Country World Index ETF, which is also down 1.3%. The India ETF is up by 4.75% this year.

On CNBC TV this week, Harsh Modi at JPMorgan discussed the opportunities in India’s banking sector and said that their asset quality is “one of the cleanest” in the Asia-Pacific region.

We also had a debate on investment preferences between China and India. Alexander Cousley of Russell Investments shared why he prefers the China market over the India market on a valuation basis. But Bhaskar Laxminaryan of Julius Baer contrasted that the India market is a story that is just getting started.

What else happened?

Indians head to the polls in the world’s largest democratic election. You probably don’t need a reminder but elections start Friday and will pan out in seven phases over the next six weeks. Voters will decide who fills the seats of the Lok Sabha, which is the lower house of Parliament, for the next five years.

IMF raises growth prediction for this year. Amid a flurry of reports and comments from the International Monetary Fund this week, India was given a 0.3 percentage point increase on its GDP rate this year — now at 6.8% — from its January update. It said the robustness reflected “continuing strength in domestic demand and a rising working-age population.”

The cost to ride on India’s luxury trains may surprise you. Our travel team revealed the pricing for these luxury trains which blend historical elegance with modern comforts. These trains were introduced to promote tourism in the country and provide travelers with an opulent way to experience India.

These are the top 5 companies to work for in India. CNBC Make It took a look at a new LinkedIn list which shows companies that are prioritizing their employees’ experience and growth. Tata Consultancy Services came out on top, but here’s the full list.

What’s happening next week?

Aside from the election, we’ll have the FPO of the Indian mobile network operator Vodafone Idea.

An FPO, or follow-on offering, is another public offering that happens after the company’s IPO. In this case it’s a chance for Vodafone Idea to raise more funds to expand its services. It opens Thursday and closes Monday with the listing on April 25.