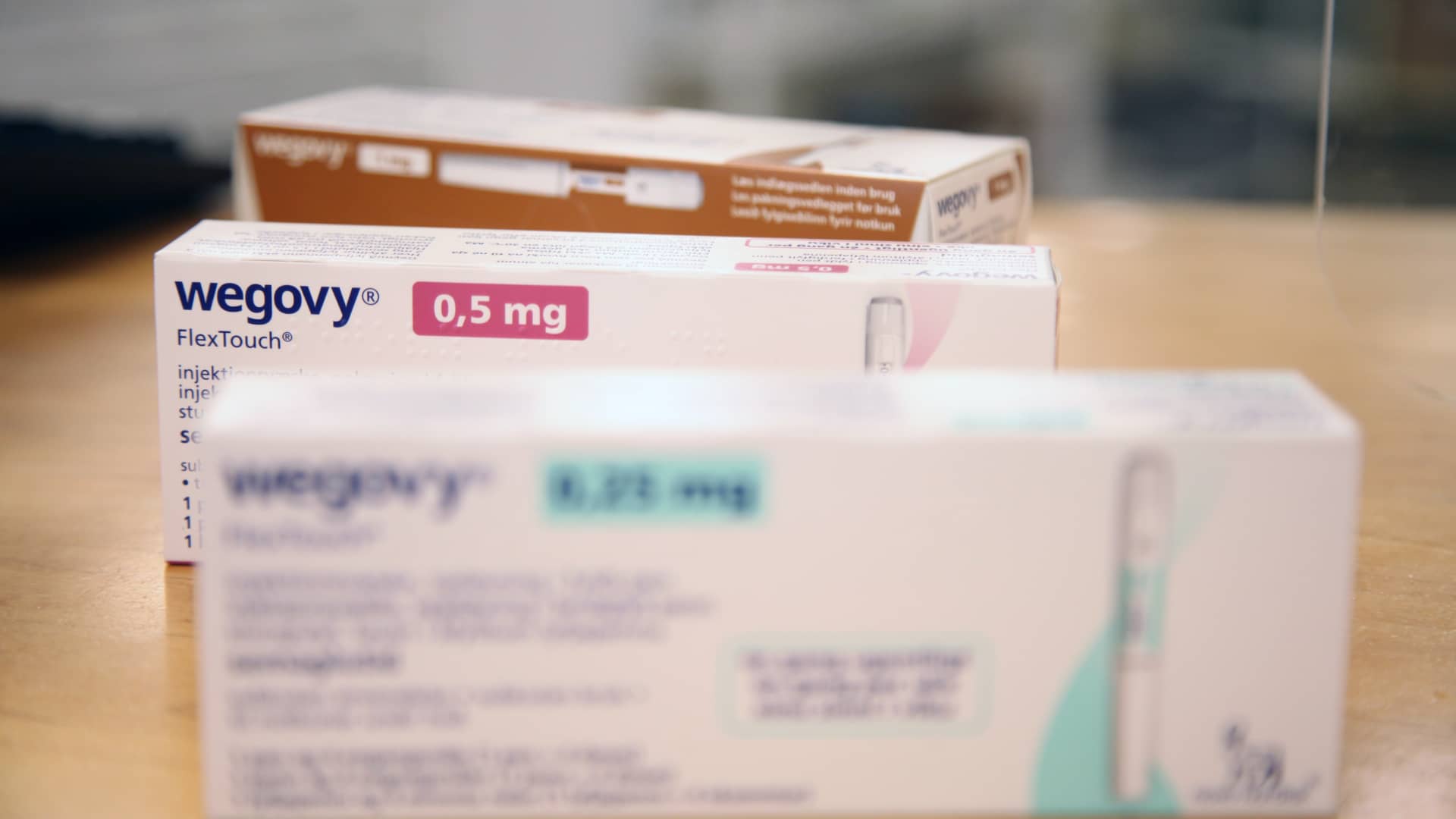

Packages of the weight-loss drug Wegovy from the pharmaceutical company Novo Nordisk lie on the sales counter in a Danish pharmacy.

Stefan Trumpf | Picture Alliance | Getty Images

Danish pharmaceutical giant Novo Nordisk is set to launch its hugely popular Wegovy obesity drug in Germany this month, but it could be some time before many patients see the benefits.

High costs and supply constraints threaten to weigh heavy on the rollout, even as the company aims to emulate in Europe the runaway success its weight loss drug has seen in the U.S.

Germany — Wegovy’s third European launch territory and the continent’s largest pharmaceuticals market — presents a vast potential customer base, with more than half (52.1%) of citizens registered as overweight.

However, strict legislation means that slimming, weight-loss and appetite-suppressant medications are not covered by the country’s public health insurance program, meaning the vast majority of potential users will be left to foot the bill themselves.

“Since such uses are considered a matter of individual responsibility and personal lifestyle, these medications are not statutorily financed by the solidarity-based community of those insured,” a spokesperson for Germany’s health ministry told CNBC via email. The country’s public health insurance program covers around 90% of its residents.

Hefty price tag

Wegovy is expected to retail between 170 and 300 euros ($190-$330) per month in Germany, according to pricing data shared with CNBC by Novo Nordisk. That’s well below the U.S. list price of $1,350, although many users are eligible for subsidies.

Still, it’s seen as too expensive for many public health systems in Europe.

Even in Denmark — Novo Nordisk’s home market — an application for Wegovy to receive public health insurance coverage was rejected on the grounds that its cost was incommensurate with its therapeutic value.

The country’s largest private health insurer, Danmark, also announced that it would stop providing subsidies for weight loss drugs from next year due to a “huge increase” in demand.

They’re obviously in a capacity constrained environment and we don’t know how much they’re willing to allocate to Europe.

Emily Field

head of European pharmaceuticals equity research at Barclays

In Norway, Wegovy’s second European market, the drug is not covered by the public health system, though Ozempic, its predecessor, is reimbursed for the treatment of type 2 diabetes.

Meanwhile, in the U.K., initial access to Wegovy under a two-year pilot program will be via hospital specialists and limited to those with a BMI (body mass index) of at least 35 and one weight-related condition, such as diabetes or high blood pressure. As such, only around 35,000 people will be able to access treatment when tens of thousands more could be eligible.

The German Obesity Society — which has received funding from Novo Nordisk — argued that such policies restrict weight-loss treatments only to wealthy individuals, who can afford such drugs out of pocket, and called on public health systems to do more to extend treatment and prevention measures.

“People living with obesity often have to bear the financial burden of their medical treatment themselves. This significantly hinders evidence-based treatment and exacerbates health inequality,” a spokesperson for the group told CNBC.

Supply constraints

Emily Field, head of European pharmaceuticals equity research at Barclays, noted that this might not be enough to dampen demand in Germany, one of Europe’s wealthiest markets.

“Even at current prices in Germany, I still think there will be a decent amount of out-of-pocket demand,” she told CNBC via Zoom. “The interest is very, very real.”

Limited supply, on the other hand, could hinder momentum in an industry forecast to be worth £200 billion within the next decade.

In May, Novo Nordisk announced that it was cutting the supply of starter doses of its obesity drug in the U.S. as it struggled