For Amazon Prime members, the Prime Visa card consistently offers the most rewards of any card on purchases at Amazon.com, Whole Foods Market, and Amazon Fresh. That includes 5% cash back at Amazon’s flagship brands, which you can redeem in exchange for Amazon purchases or as a statement credit. Plus, the card features purchase protection and extended warranty benefits. Whether you’re buying groceries or investing in a new laptop, if you’re buying from Amazon, it’s difficult to justify using any other card.

Here’s what you need to know about the Amazon Prime Visa card:

Prime Visa review

Highlights

- Earn unlimited 5% cash back on Amazon.com, Whole Foods Market, and Amazon Fresh purchases.

- Earn 5% cash back on Chase Travel purchases.

- Earn 2% cash back at gas stations, at restaurants, and on local transit and commuting.

- Extended warranty protection and purchase protection.

- Travel insurance protections including auto rental collision damage waiver, baggage delay insurance, and lost luggage reimbursement.

Prime Visa pros and cons

The Prime Visa card offers more rewards at more places than other store credit cards with no annual fee.

Pros

- 5% cash back on every purchase at Amazon.com, Whole Foods Market, Amazon Fresh, and Chase Travel.

- Purchase protection and extended warranty protection.

- Rewards are available to redeem as soon as the next day.

- No annual fee.

Cons

- The Prime Visa is only available to Amazon Prime members.

- Other no-annual fee cards offer greater rewards on non-Amazon purchases.

Current welcome offer

The Amazon Prime Visa card offers a welcome bonus to new customers that changes frequently. New cardmembers can typically get an Amazon gift card or a statement credit upon approval.

As of July 2023, the Prime Visa offered a $200 Amazon gift card to new cardholders upon approval. This offer ends on 7/26/23.

How to earn rewards

Earning 5% with your Prime Visa is as simple as buying things at Amazon.com, Whole Foods Market, and Amazon Fresh. Just use your card at checkout and you’ll earn 5% rewards on all of your Amazon purchases.

In addition to its 5% rewards, Prime Visa card offers cardmembers 10% cash back on a rotating selection of items and categories at Amazon.com. Although it’s not an advertised card benefit, Amazon has also been known to give cardmembers more cash back on Prime Day. During Prime Day in July 2023, Prime Visa cardmembers got 6% cash back for purchases and 7% cash back when they opted for slower shipping during Prime Day.

Finally, you’ll earn 2% cash back when you use your card at gas stations and restaurants, as well as on local transit and commuting. Other purchases earn 1% cash back.

If you discontinue your Prime membership, your Prime Visa will become an Amazon Visa and earn 3% cash back in the card’s featured categories.

How to redeem rewards

With the Amazon Prime Visa card, most of your rewards can be redeemed as early as the day after you make a purchase.

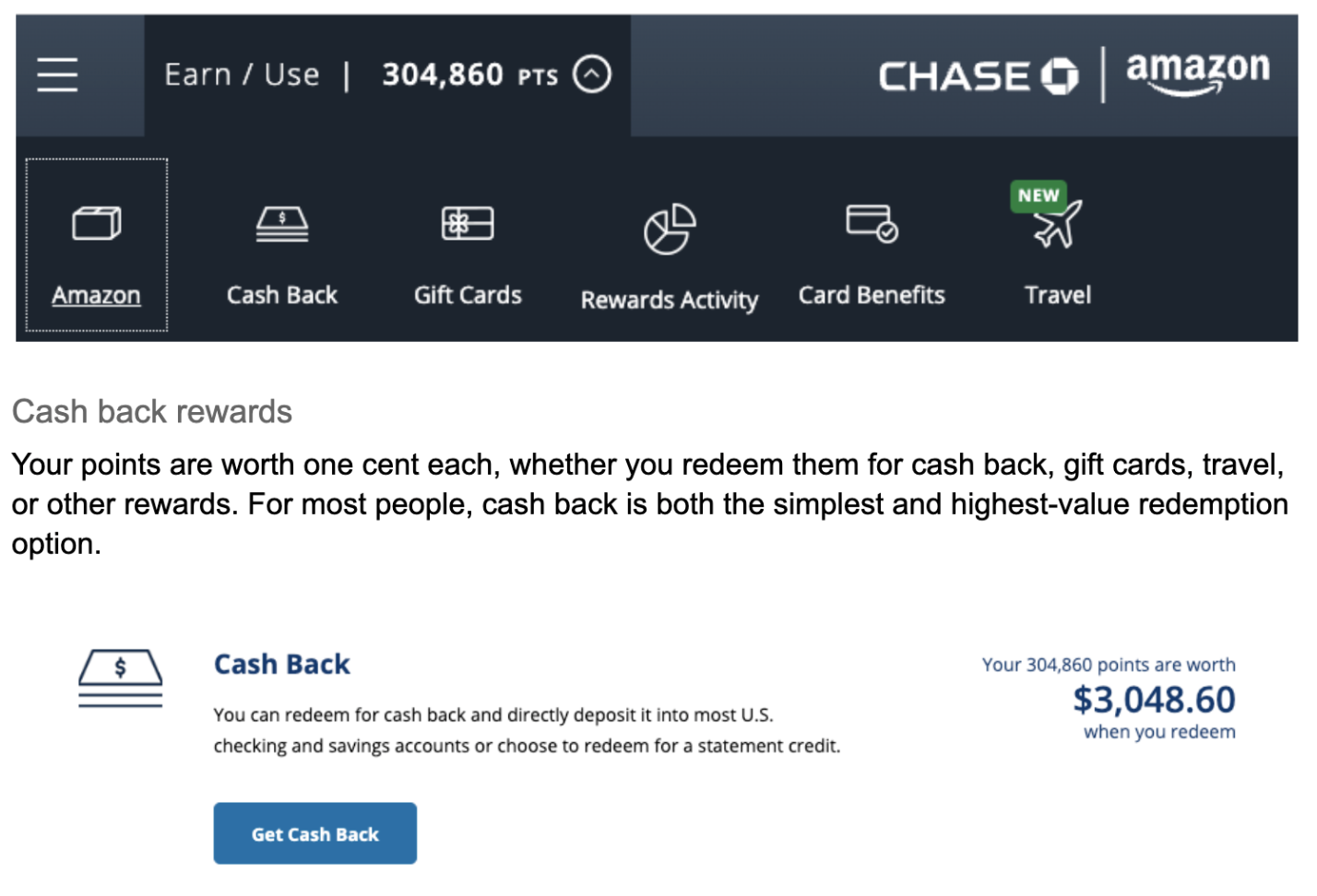

Redeeming your rewards is simple through Chase online. Just log in to Chase.com, navigate to your credit card account, and select the “Redeem” link near your point balance to see your redemption options.

Redeeming your rewards is simple through Chase online.

You can opt to receive your cash back award as a statement credit or have it deposited into a linked checking or savings account. Once you request a redemption, you’ll receive your cash back credit within three business days.

Other redemption options

Here are the other redemption options offered by the Amazon Prime Visa:

- Pay with points on Amazon.com

- Gift cards to popular merchants

Travel Benefit highlights

Purchase protection and extended warranty protection

Most items you purchase using your Prime Visa card will be covered by Chase purchase protection and extended warranty protection. Purchase protection covers your new purchases against damage or theft. Extended warranty protection gives you additional coverage equivalent to your manufacturer’s warranty.

If an item you buy with your Amazon Prime Visa card is stolen or breaks within 120 days of your purchase, you can be covered by purchase protection. Your purchase protection benefit will pay to repair or replace your eligible item, up to $500. In most cases, purchase protection doesn’t apply if you lose an item you purchased.

If something you buy with the card stops working after the manufacturer’s warranty expires, the Prime Visa’s extended warranty benefit kicks in. Extended warranty gives you an additional year of warranty coverage on manufacturer’s warranties of three years or less when you purchase an item with your card. Extended warranty protection covers the same types of defects as a typical manufacturer’s warranty.

Travel insurance protections

In addition to purchase protection, you’re covered by a handful of travel-related benefits when you use your card for flights, hotels, car rentals, and more.

- Auto rental collision damage waiver – Get coverage against damage or theft on a rental car when you decline the rental car agency’s collision damage waiver insurance. This benefit provides secondary coverage in the U.S.

- Baggage delay insurance – Receive reimbursement for essentials like toiletries and clothing when your baggage is delayed by over six hours.

- Lost luggage reimbursement – If your luggage is lost or damaged by an airline, you can be reimbursed up to $3,000 per passenger.

- No foreign transaction fees – Pay no fee when you make purchases outside of the United States.

Who it’s good for

If you have an Amazon Prime membership, the Prime Visa should be in your wallet. No other card offers unlimited 5% cash back on Amazon purchases — and the inclusion of extended warranty and purchase protection benefits mean that there is rarely ever any reason to use another card at Amazon. The fact that it rewards you with 5% cash back on grocery purchases at Amazon Fresh and Whole Foods makes it that much more appealing.

Who should look elsewhere

If you don’t have an Amazon Prime membership, you likely don’t spend much on Amazon and you’ll be offered the (non-Prime) Amazon Visa. The Amazon Visa earns 3% cash back on purchases at Amazon, but if you’re not doing much shopping online, you can find other cards that offer more generous rewards in other categories where you spend more.

Plenty of cards offer 3% cash back on gas and groceries or 2% cash back everywhere. Target and Walmart both offer cards with 5% rewards at their stores. If the Amazon Prime Visa’s extended warranty benefit entices you, you can pick up a Chase Freedom Unlimited, which offers 1.5% rewards on all purchases.

Is the Amazon Prime Visa card worth it?

With no annual fee and 5% rewards at Amazon.com, Whole Foods Market, and Amazon Fresh, the Amazon Prime Visa is an essential card for anyone with an Amazon Prime Membership.

Looking for a different rewards credit card? We’ve got you covered.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lender’s website for the most current information.

This article was originally published on SFGate.com and reviewed by Lauren Williamson, who serves as Financial and Home Services Editor for the Hearst E-Commerce team. Email her at lauren.williamson@hearst.com.