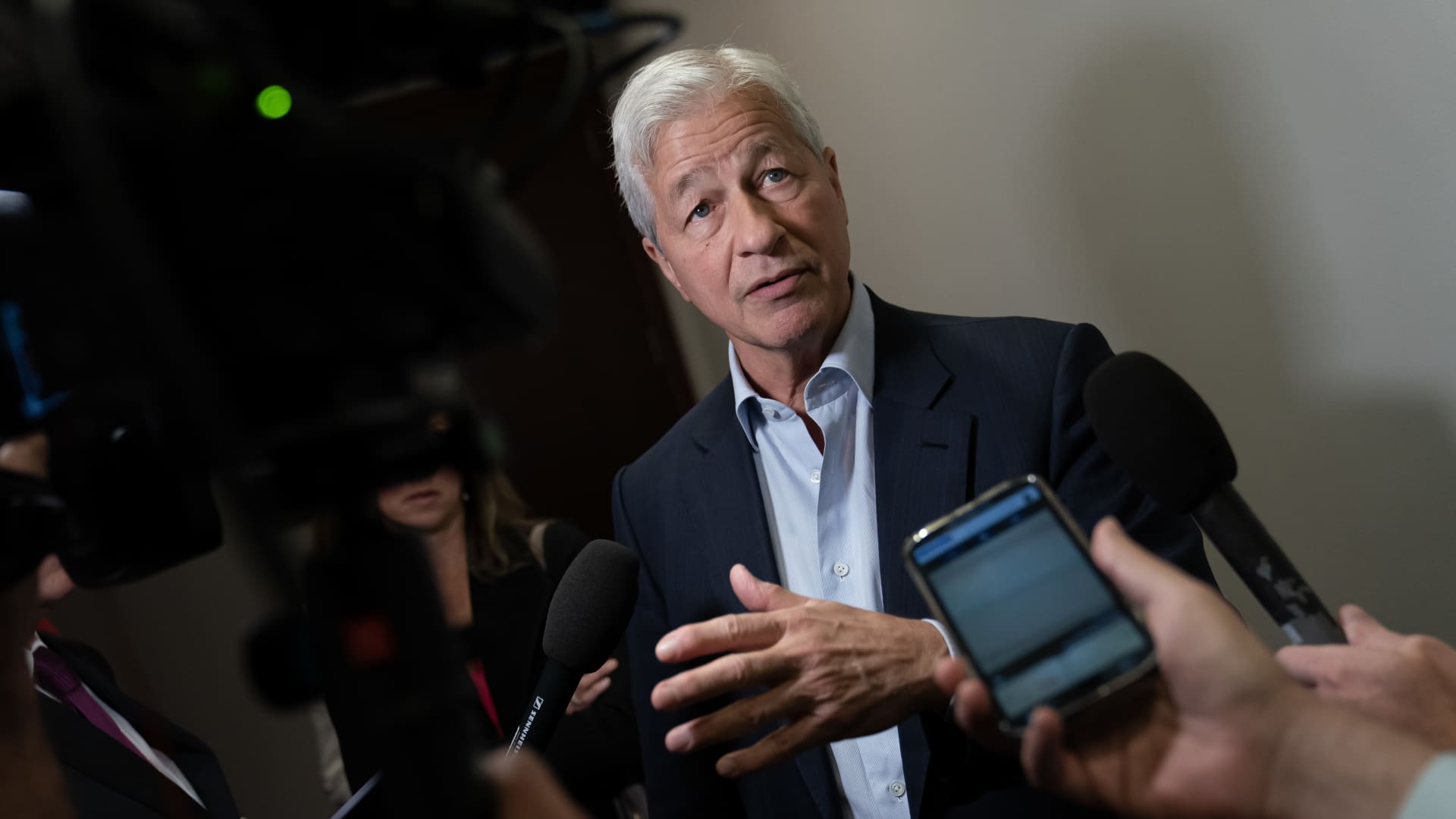

Jamie Dimon, chairman and chief executive officer of JPMorgan Chase & Co., at the US Capitol for a lunch meeting with the New Democrat Coalition in Washington, DC, US, on Tuesday, June 6, 2023.

Nathan Howard | Bloomberg | Getty Images

JPMorgan Chase reported second-quarter earnings Friday that topped analysts’ expectations as the company benefited from higher interest rates and growing interest income.

Here’s what the company reported:

- Earnings: $4.37 per share adjusted vs. $4 per share Refinitiv estimate

- Revenue: $42.4 billion vs. $38.96 billion estimate

Net income surged 67% to $14.5 billion, or $4.75 per share. When excluding the impact of its First Republic acquisition in early May — a $2.7 billion “bargain purchase gain” from the government-brokered takeover, as well as reserve builds and securities losses tied to the purchase — earnings were $4.37 per share.

Shares of the bank climbed 2.6% in premarket trading.

JPMorgan has been a standout recently on several fronts. Whether it’s about deposits, funding costs or net interest income — all hot-button topics since the regional banking crisis began in March — the bank has outperformed smaller peers.

That’s helped shares of the bank climb 11% so far this year, compared with the 16% decline of the KBW Bank Index. When JPMorgan last reported results in April, its shares had their biggest earnings-day increase in two decades.

This time around, JPMorgan will have the benefit of owning First Republic after its U.S.-brokered takeover in early May.

The acquisition, which added roughly $203 billion in loans and securities and $92 billion in deposits, may help cushion JPMorgan against some of the headwinds faced by the industry. Banks are losing low-cost deposits as customers find higher-yielding places to park their cash, causing the industry’s funding costs to rise.

That’s pressuring the industry’s profit margins. Last month, several regional banks disclosed lower-than-expected interest revenue, and analysts expect more banks to do the same in coming weeks. On top of that, banks are expected to disclose a slowdown in loan growth and rising costs related to commercial real estate debt, all of which squeeze banks’ bottom lines.

Lenders have begun setting aside more loan-loss provisions on expectations for a slowing economy this year. JPMorgan is expected to post a $2.72 billion provision for credit losses, according to the StreetAccount estimate.

The bank won’t be able to sidestep downturns faced in other areas, namely, the slowdown in trading and investment banking activity. In May, JPMorgan said revenue from those Wall Street activities was headed for a 15% decline from a year earlier.

Finally, analysts will want to hear what JPMorgan CEO Jamie Dimon has to say about the health of the economy and his expectations for banking regulation and consolidation.

Wells Fargo also reported earnings Friday, and Citigroup results are on deck. Bank of America and Morgan Stanley report Tuesday. Goldman Sachs discloses results Wednesday.

This story is developing. Please check back for updates.