Happy Friday! It’s January 26, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

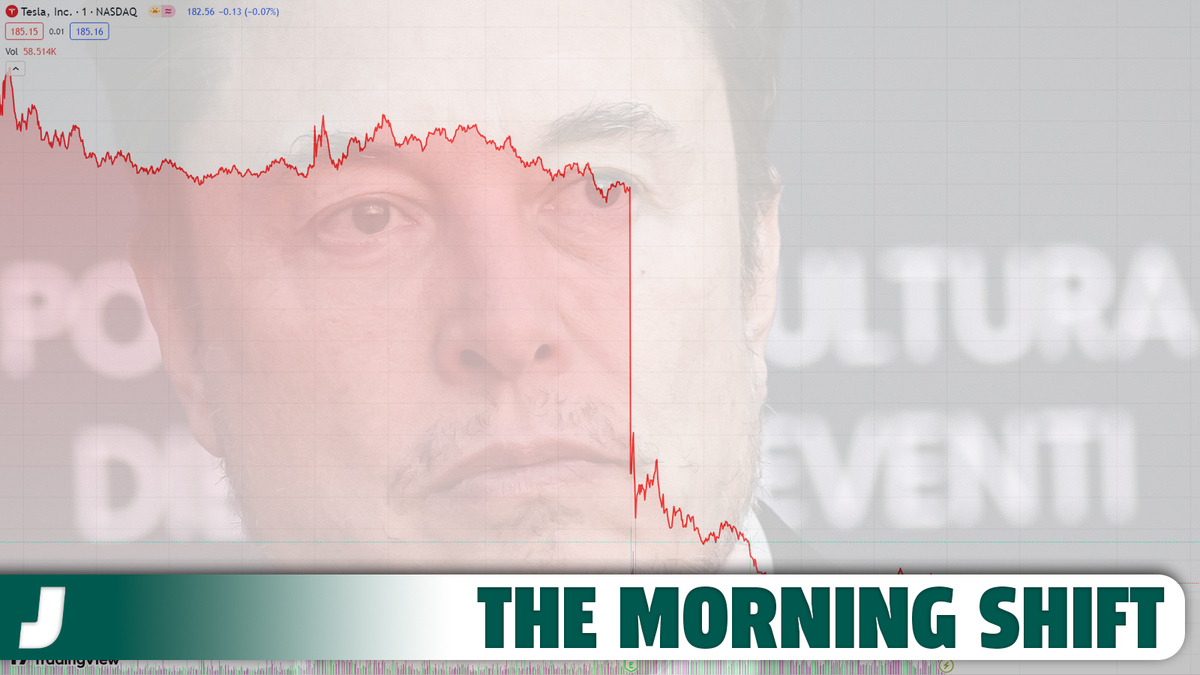

1st Gear: Tesla Stock Keeps Falling After Warning Of Soft 2024 Growth

Just yesterday, we talked about Tesla’s eight percent drop in share price after Elon Musk warned of a slow growth year in an earnings call. It seems, however, that wasn’t the end of the troubles for $TSLA — the stock continued to fall all day Thursday. The Wall Street Journal explains why:

Despite being valued like a technology company, Tesla has run into an old-fashioned car-industry problem: the model cycle.

In its results for the fourth quarter, published after the bell on Wednesday, the electric-vehicle maker replaced its previous boilerplate guidance about growing “as quickly as possible” with an admission that it is “between two major growth waves.” The spurt provided by the Model 3 and Model Y has run its course. The next one will be “initiated by the global expansion of the next-generation vehicle platform.”

As of this writing, Tesla’s fall-off after the earnings call sat at over 12 percent, though shares have started strong with a one-percent jump this morning. We love the wild swings of The Economy, don’t we folks?

2nd Gear: Britain Is Still Figuring Out The Whole Brexit Thing

Fun fact about being an independent nation: You get to make all your own rules. Terrible fact about being an independent nation: You have to make all your own rules, including all those pesky little ones around international trade and commerce. Britain doesn’t seem to have thought about the latter when Brexiting from the EU, and is still figuring out exactly how that’s all going to work, and the car industry is feeling the strain. From Reuters:

LONDON, Jan 26 (Reuters) – Britain’s decision to suspend talks with Canada on a free trade deal creates the risk of tariffs being imposed on British-made cars sold in Canada, the UK car industry warned on Friday, as it urged the two sides to return to negotiations.

Under Britain’s existing trade deal with Canada, which effectively rolled over after Brexit, UK carmakers can until April export vehicles containing EU-manufactured parts to Canada without facing tariffs.

…

Britain on Thursday suspended talks on a free trade deal with Canada amid unhappiness on both sides about the lack of access to agricultural markets.

Since leaving the EU in 2020, Britain has been trying to forge bilateral trade deals across the globe. It is currently negotiating a free trade agreement with India.

Remember when you were a kid, dreaming of growing up so you could have candy for dinner every night? Then you do grow up, and it turns out candy for dinner is terrible for you, and you have to pay taxes now? I imagine that’s more or less what Downing Street feels like right now.

3rd Gear: Lincoln Ditched 100 Dealers Last Year, And Plans Another 100 In 2024…

It’s a very weird time for dealerships right now. Some brands are abandoning them entirely, others are just getting their feet wet with independent stores; some places hate them, others legally require them, it’s a whole mess — a mess that Lincoln, it seems, is trying to divest from. From Automotive News:

Lincoln Motor Co. shed a record 100 U.S. dealerships in 2023 and plans to slash 100 more this year as it seeks a smaller, more profitable retail network.

By year end, Ford Motor Co.’s luxury arm expects to have roughly 400 stores, about 40 percent fewer than in 2021 but still more than most other luxury brands have.

The Automotive News comparison to “other luxury brands” is interesting. Lincoln, in price and prestige, sits in an area not unlike Buick — it’s not as low-volume, high-profit as a Rolls, yet doesn’t do the numbers of Ford. I don’t envy the job of whoever has to dial in that perfect dealer network size.

4th Gear: …But Fisker Is On The Hunt For More Dealers To Add

See what I mean about a weird time for dealers? Fisker, a company that’s relied on direct sales for its entire life, is now looking to expand into the dealership game. It’s so interested, in fact, that Henrik Fisker himself is courting dealer owners in California, per Automotive News:

Fisker Inc. CEO Henrik Fisker sees his first NADA show in early February as a key opportunity to recruit U.S. dealers and show off the Ocean crossover as the EV brand shifts from direct sales to third-party retailers.

Henrik Fisker told Automotive News Thursday that more than 65 dealers have shown interest in the brand since it announced the shift in sales strategy this month.

Careful readers may notice that Fisker’s interest of 65 dealers is lower than Lincoln’s downsizing target of 400. The former has always been a lower-volume seller than the latter, but it’ll be interesting to see just how much of a sales difference those few stores really make.

Reverse: Britain Has Never Left Well Enough Alone

Neutral: At Least We Got A Little Bit Of Snow

It’s back to being unseasonably warm in New York, with temps in the 50s and humidity at approximately 1,000 percent. As happy as I am about motorcycle weather in January, I am also terrified at the prospect of motorcycle weather in January.